Think of an AI yield aggregator as a brilliant financial advisor for your crypto, one that never sleeps. It's a DeFi tool that uses artificial intelligence to automatically sniff out the best yield farming opportunities across the entire crypto market and puts your capital to work—saving you from hours of tedious, complex manual effort.

From Manual Chaos to Automated Clarity

The world of Decentralized Finance (DeFi) is an absolute goldmine of opportunities to earn returns, or "yield," on your crypto. But trying to navigate this landscape on your own is a massive headache. You'd have to constantly research new protocols, compare ever-changing Annual Percentage Yields (APYs), and burn through cash on gas fees for every single move.

This manual approach isn't just inefficient; it's a recipe for mistakes and emotional decisions. Can you imagine trying to keep track of hundreds of investment options that shift every minute? It's a full-time job, and frankly, an impossible one for a single person. This is the exact problem an AI yield aggregator is built to solve.

An AI yield aggregator transforms the frantic, high-effort scramble of yield farming into a calm, hands-off passive income strategy. It kills the guesswork and replaces it with pure, data-driven automation.

The Automated Solution to DeFi Complexity

Instead of you doing all the heavy lifting, the aggregator uses smart automation to handle everything. It effectively becomes your personal portfolio manager, executing a sophisticated strategy without needing you to check in constantly. This makes high-level DeFi strategies accessible to anyone, not just the hardcore traders who live and breathe charts.

This technology directly tackles the biggest pain points of old-school yield farming:

Constant Monitoring: The AI is always scanning the market, 24/7. It never takes a break, ensuring no juicy opportunity is ever missed.

High Transaction Costs: By intelligently bundling transactions and optimizing its moves, the platform helps slash the gas fees that can eat away at your profits.

Overwhelming Complexity: It boils the entire process down to one simple action: depositing your funds. The AI takes it from there.

By taking over the complicated research and relentless execution, an AI yield aggregator gives you back your time while making your capital work smarter, not harder. To get a handle on the basic ideas, you can learn more about how a traditional yield aggregator works in our detailed guide. AI builds on those same principles, just adding a powerful layer of intelligence to crank up performance and manage risk.

How AI Gets the Job Done for Your DeFi Strategy

So, how does an AI yield aggregator actually work its magic? It’s less like a single tool and more like having a dedicated, hyper-efficient investment team working for you around the clock. This isn't about gut feelings or chasing trends; it’s about replacing manual effort and emotional decisions with cold, hard data and relentless automation.

At its core, the technology is a symphony of three key parts working together. Each one has a specific job, turning the often chaotic world of DeFi into a structured system designed to protect your capital and find real, sustainable yield. Let's pull back the curtain and see how these pieces fit together.

The Tireless Scouts: AI Data Agents

First up, you have the AI data agents. Think of these as thousands of scouts fanned out across the entire DeFi landscape. They never sleep, working 24/7 to scan countless liquidity pools, staking protocols, and lending markets across different blockchains.

Their one and only mission? Pinpoint the highest and most stable Annual Percentage Yields (APYs) available at any given moment. A human might check a few favorite platforms now and then, but these agents are monitoring everything in real time. No promising opportunity slips through the cracks. This constant market surveillance is the bedrock of the entire strategy.

The Cautious Analysts: Machine Learning Risk Models

Once the scouts flag a promising opportunity, the next specialist steps in: the machine learning risk models. Picture these as obsessively cautious risk analysts. They see the flashy APY, but their job is to look much, much deeper to figure out if a protocol is actually safe.

These algorithms crunch a massive amount of data to generate a comprehensive risk score for every potential investment.

Smart Contract Security: The model dives into audit reports and on-chain transaction history, actively looking for vulnerabilities or red flags.

Protocol History: It checks how long the protocol has been around, its track record, and whether it’s ever been hacked or exploited.

Market Sentiment: It even scrapes data from social media and news outlets to get a read on community trust, sniffing out potential FUD or shady activity before it becomes a problem.

Many of these strategies are executed through automated smart contracts, which are basically self-executing agreements with the rules baked directly into the code. The AI's ability to vet these contracts before committing any funds is a huge security advantage. It's a data-first approach that steers your capital away from dodgy projects and outright scams, putting safety right alongside returns.

By marrying high-yield discovery with hardcore risk analysis, an AI yield aggregator isn't just chasing the biggest numbers—it's hunting for the smartest ones.

The Swift Executor: Dynamic Portfolio Rebalancing

Finally, with the best risk-adjusted opportunities identified, the dynamic portfolio rebalancing engine takes the lead. This is the executor, the one that moves your capital with speed and precision. When a better, safer opportunity pops up, it automatically shifts funds to capture that new yield.

It works the other way, too. If an existing position sees its yield drop or its risk profile suddenly spike, the AI pulls the plug and reallocates that capital somewhere safer and more profitable. This all happens on its own, often batching transactions to keep those pesky gas fees to a minimum.

The growth in this tech is undeniable. The global DeFi yield farming market is on track to grow from $86.2 million to $154 million by 2031, a surge largely fueled by these kinds of AI-driven optimizations.

This intelligent automation is where the real power lies. It's a system that's constantly learning, adapting, and working to maximize your returns without you having to lift a finger. If you want to go deeper down the rabbit hole, you can explore the nuts and bolts of machine learning trading algorithms in our comprehensive guide.

Comparing AI Aggregators to Manual Yield Farming

So, should you use an AI yield aggregator or just farm manually? It really boils down to choosing between a self-driving EV and a classic stick-shift sports car. Both get you where you’re going, but the experience, the effort involved, and the sheer efficiency are miles apart. Going manual offers that hands-on thrill, but it demands your constant attention and a whole lot of skill to do it right.

An AI yield aggregator, on the other hand, is built for pure performance and efficiency. It does all the heavy lifting for you. Think of it as your personal chauffeur navigating the chaotic streets of DeFi markets 24/7, making thousands of tiny decisions to find the smoothest, fastest, and most profitable path. It never gets tired, never gets distracted, and it definitely won't make emotional mistakes when the market gets choppy.

The fundamental difference comes down to data processing and speed. A human can realistically keep track of a handful of protocols at once. An AI can scan thousands simultaneously, catching those fleeting opportunities that disappear in minutes. Honestly, that's an advantage that manual farming just can't compete with.

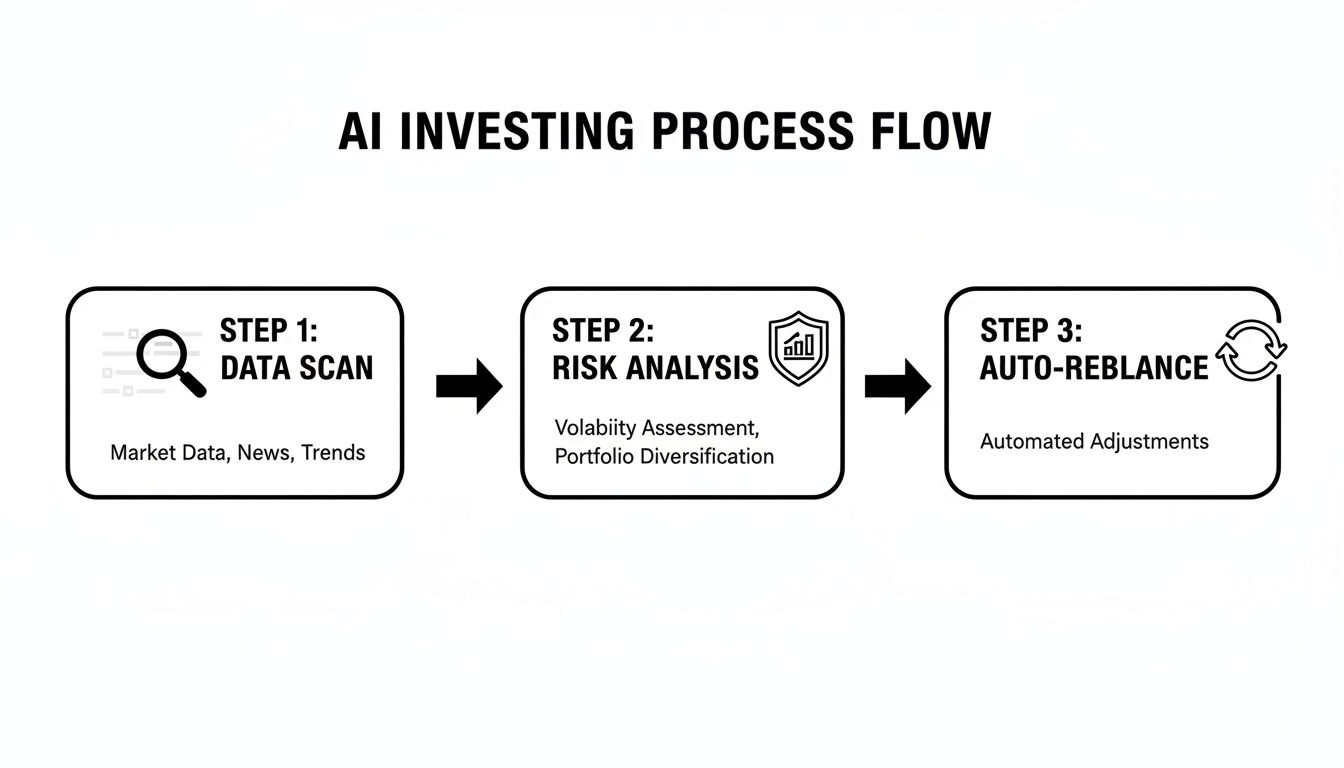

This whole process is a continuous loop: scan, analyze, and rebalance. It’s what keeps your capital working smart, not just hard.

This automated cycle is the engine that drives performance, swapping out manual guesswork for data-backed precision.

The Head-to-Head Breakdown

Let’s get into the nitty-gritty of how these two approaches stack up. While manual farming gives you that feeling of direct control, it comes at a steep price in time, transaction fees, and the ever-present risk of messing up. An AI aggregator automates all of that, transforming a high-stress activity into something you can set and forget.

Time Commitment: Let's be real—manual farming is basically a part-time job. It demands hours of research and monitoring every single day. AI aggregators slash that time commitment to almost zero after you've made your initial deposit.

Strategy Complexity: A manual farmer has to dream up, test, and then execute complex strategies. The AI comes ready to go with advanced strategies that are constantly being tweaked and optimized.

Transaction Costs: Every move you make in manual farming—depositing, withdrawing, rebalancing—costs you gas fees. AI platforms are smart about this; they batch transactions together, which drastically lowers these costs for each individual user.

Human Error: One wrong click, a missed rebalance, or a moment of panic-selling can wipe out weeks of hard-earned gains. Automation takes those emotion-driven blunders completely out of the picture.

To put it simply, the choice between an AI yield aggregator and manual farming comes down to how you value your time and how you want to manage risk.

Below is a table that lays out the key differences. It’s pretty clear that while both methods aim for yield, the journey couldn't be more different.

AI Yield Aggregator vs Manual Yield Farming

Feature | AI Yield Aggregator | Manual Yield Farming |

|---|---|---|

Operational Hours | 24/7/365, fully automated | Limited to when you are awake and online |

Market Coverage | Scans thousands of protocols across multiple chains | Limited to a handful of familiar protocols |

Risk Management | Continuous data-driven risk scoring and diversification | Relies on manual research and gut feeling |

Profit Compounding | Automatic and frequent, maximizing returns | Manual and often infrequent due to gas costs |

Ultimately, choosing an AI yield aggregator isn't just about taking a shortcut. It’s a strategic upgrade. You’re moving from a labor-intensive, hands-on process to a sophisticated system designed to handle the speed, scale, and complexity of today's DeFi markets.

The Strategic Benefits of Using an AI Yield Aggregator

Sure, the main promise of an AI yield aggregator is to hunt down the highest returns for you. But honestly, its real value is the whole package—a combination of advantages that work together to make your crypto portfolio smarter, stronger, and more resilient. This is about more than just chasing high APYs; it's a fundamental upgrade to how you interact with DeFi.

By moving past the manual grind, these platforms offer a level of performance and security that’s just plain impossible for one person to achieve alone. Let’s break down the four key benefits that set this AI-powered approach miles apart from the old way of doing things.

Optimized Returns Through Auto-Compounding

The most immediate benefit you'll notice is how your earnings multiply through relentless auto-compounding. Think of it like a snowball rolling downhill—it starts small but picks up speed and grows exponentially. An AI aggregator does the same by automatically reinvesting every cent you earn right back into your strategy.

This means your profits start generating their own profits, creating a powerful growth curve that's nearly impossible to match by hand. Manual compounding gets bogged down by high gas fees and the sheer hassle of doing it constantly.

By turning every small gain into a future earning machine, AI-powered auto-compounding ensures your capital is always working as hard as it possibly can, squeezing every last drop of value from the market.

Smarter Risk Management

An AI yield aggregator isn't just an optimist; it’s a stone-cold realist. Before it even thinks about deploying your funds, its machine learning models run a tough background check on every potential protocol. It pores over smart contract audits, historical performance, and on-chain data to weed out the sketchy or unreliable projects.

On top of that, the AI automatically spreads your capital across multiple vetted protocols. This diversification is your safety net, making sure a problem in one corner of DeFi doesn’t tank your whole portfolio. It's like having a 24/7 risk management team watching your back.

Unmatched Efficiency and Cost Savings

Let's be real: manual yield farming is expensive. Every transaction—depositing, withdrawing, swapping—comes with a gas fee that nibbles away at your profits. An AI yield aggregator fixes this by bundling thousands of user transactions into a single, optimized operation.

This batching dramatically slashes the cost for each person, making it affordable to rebalance positions frequently. The AI does all the heavy lifting, saving you a ton of money on fees and freeing up countless hours you'd otherwise spend glued to a screen.

Democratized Access to Advanced Strategies

Historically, the most lucrative DeFi strategies were a closed club, reserved for pro traders with deep pockets and even deeper knowledge. These complex moves were just too difficult and time-consuming for the average person to pull off.

AI aggregators are kicking the door down. They package these sophisticated, multi-step strategies into a simple "deposit and earn" experience. This democratizes access to institutional-grade opportunities, letting anyone tap into profits that were once exclusive to the pros.

It’s no surprise that AI now powers 89% of global trading volume. In DeFi, AI-driven platforms are already achieving 20-40% higher yields than manual approaches by using AI for optimization. You can explore more about these AI statistics and their impact on finance to see just how big this shift really is.

Leading Platforms and Real-World Applications

All the theory is great, but seeing an AI yield aggregator in the wild is where it really clicks. These aren't just concepts on a whiteboard; they are active platforms managing billions of dollars and generating real returns for everyone from individual crypto holders to massive organizations.

The applications are surprisingly diverse. We're talking about everything from simple, hands-off passive income to sophisticated treasury management for entire DAOs.

By looking at a couple of the top players, you can get a feel for how different platforms are built for different people. Whether you're all about iron-clad security or you chase the highest yields across multiple blockchains, there’s an AI-powered tool built for you.

Generating Passive Income for Retail Investors

Let's be honest, for most everyday crypto users, the goal is simple: make your crypto work for you. You want consistent, passive income without turning into a full-time portfolio manager glued to a screen. This is the absolute sweet spot for an AI yield aggregator. These platforms throw open the doors to complex DeFi strategies that used to be out of reach, making them accessible with just a few clicks.

Two names really stand out here:

Yearn Finance is one of the OG's in this space and has earned a reputation for being incredibly trustworthy. If you’re the "set-it-and-forget-it" type who values a long, reliable track record, Yearn's vaults are for you. They are famously risk-averse, meticulously vetting every strategy to make sure preserving your capital is just as important as getting a competitive return.

Beefy plays a different game. It’s a multi-chain monster. If you want to squeeze every last drop of yield from various blockchains like Polygon, Arbitrum, or Base, Beefy is your go-to. Its AI-driven vaults are relentless, automatically compounding your rewards over and over to maximize your profits across a huge range of assets.

The results can be pretty wild. One real-world example showed a DeFi portfolio using top-tier platforms like Yearn and Beefy ballooning to over $1.2 million. That was a mind-boggling 24x return on an initial investment and contributions of about $120,000, which just goes to show what's possible when you let automated strategies do the heavy lifting.

Sophisticated Treasury Management for DAOs

It's not just individuals who benefit. Think about Decentralized Autonomous Organizations (DAOs) and Web3 companies. They often have huge treasuries sitting around, mostly in stablecoins. If that money just sits there, inflation eats away at its value. An AI yield aggregator is the perfect fix, putting those idle funds to work safely and efficiently.

By allocating a portion of their treasury to audited, AI-managed vaults, DAOs can generate a steady operational income stream. This revenue can fund development, pay contributors, or grow the treasury itself—all without requiring a dedicated financial team to manage positions manually.

This simple move transforms a static pile of cash into a productive, self-sustaining asset. The platform's built-in risk models ensure the capital flows into low-risk, stablecoin-focused strategies, which is exactly what you want when you're managing a treasury.

For anyone curious about building these kinds of groundbreaking financial tools, diving into specialized Fintech Software Development Services is a great starting point. These platforms are a massive leap forward for on-chain finance.

How to Evaluate Security and Trust in DeFi

Let's be real. In the world of DeFi, those juicy APYs mean absolutely nothing if your funds aren't safe. Before you even think about depositing a single dollar into an AI yield aggregator, you have to do your homework. Trust isn't something you just give away; it has to be earned through total transparency and battle-tested code.

The first, absolute, non-negotiable step is the smart contract audit. Think of it like hiring a structural engineer to inspect a skyscraper's foundation before you move into the penthouse. Reputable third-party security firms need to have combed through every single line of the platform's code, hunting for vulnerabilities that could be exploited.

Seriously, never invest in a platform that hasn't been audited by well-known firms. Look for a history of audits, not just one. It shows a real, long-term commitment to keeping your money safe.

Looking Beyond the Audit Report

An audit is critical, but it's just one piece of the security puzzle. A project's history and the transparency of its team are just as important when you're figuring out who to trust. You need to dig into their track record and see how they talk to their community.

Here’s a quick checklist for your own due diligence:

Track Record: How long has this platform been running without any major hacks or issues? A project with a multi-year history of keeping funds safe is a much better bet than something that launched last week.

Team Transparency: Do you know who the founders and developers are? Anonymous teams are a massive red flag in DeFi.

Incident Response: Has the platform ever had a security problem? If so, find out exactly how they handled it. Were they open about what happened? Did they make users whole? Did they implement fixes so it wouldn't happen again?

A platform's true character is revealed not when things are going well, but in how it handles a crisis. A swift, transparent, and user-focused response to a problem builds far more trust than a flawless but unproven record.

If you want to go deeper on this, check out our guide on how to approach a smart contract security audit and what to look for.

Finally, keep an eye out for extra layers of protection like decentralized insurance funds. Some platforms will set aside a portion of their revenue to create a safety net. This fund can be used to reimburse users if a contract fails or gets exploited. It’s a proactive approach to protecting your assets and adds another solid layer of confidence.

Got Questions About AI Yield Aggregators?

We get it. Here are some of the most common questions we hear.

Are AI Yield Aggregators Safe to Use?

Look, no DeFi platform is 100% risk-free, and anyone who tells you otherwise is selling something. The real world of DeFi involves risks like smart contract bugs or wild market swings.

But, AI risk modeling gives these platforms a serious edge over going it alone. Always look for platforms that have been through multiple third-party audits and have a solid track record.

How Do These Platforms Make Money?

It's pretty straightforward. Most AI aggregators take a small performance fee from the profits they generate for you. Think of it as a success fee—they only make money when you do.

Some might have a tiny management or withdrawal fee to cover operational costs like gas fees and ongoing security audits. The APY you see displayed is almost always your net return after any fees are taken out.

Key Takeaway: Yes, it's possible to lose money. Things like impermanent loss in liquidity pools, a nasty smart contract exploit, or a sudden crash in an asset's value can happen. An AI yield aggregator is designed to drastically reduce these risks, but it can't wave a magic wand and make them disappear entirely.

Ready to put your stablecoins to work? Yield Seeker uses personalized AI agents to find and manage the best risk-aware yield opportunities for you. Start earning smarter, not harder. Get started with Yield Seeker today.