Think of automated APY discovery as a smart system, often powered by AI, that’s constantly scanning, analyzing, and moving funds to the best risk-adjusted yield opportunities in real-time. It’s a total game-changer from the old, exhausting manual process of chasing returns across the decentralized finance (DeFi) landscape. It offers a much smarter, more efficient way to make your stablecoins work for you.

Why Manual Yield Hunting Is a Losing Game

If you're holding stablecoins, the goal is pretty straightforward: make your digital dollars work harder. The old-school method, what people call "yield hunting" or "yield farming," means you're manually digging through countless DeFi protocols trying to find the highest Annual Percentage Yield (APY). But let’s be honest, for the average person, this has become an exhausting—and often losing—game.

Imagine a stock trader trying to watch hundreds of screens at once, all with prices flashing and changing every second. That's pretty much what manual yield hunting feels like today. The DeFi world is a sprawling, fragmented universe of liquidity pools, lending platforms, and strange new financial gadgets. Rates don't change daily; they can flip in a matter of minutes, driven by market swings, new token rewards, and liquidity shifts.

The Daily Grind of Chasing APYs

Going at it manually is a relentless cycle of research, number-crunching, and executing transactions. It’s not just a massive time sink; it’s also incredibly easy to mess up. You’re constantly forced to:

Discover new protocols: DeFi platforms pop up every day. Trying to sort the legit, high-potential ones from the sketchy, unaudited rug-pulls is a full-time job in itself.

Compare shifting rates: A protocol that’s offering a sweet 15% APY one day might crash to 5% the next, just as a better opportunity appears somewhere else. Keeping up with these changes is almost impossible without being glued to your screen.

Assess complex risks: You have to be a bit of a detective. Is the smart contract secure? Is the protocol’s economic model built to last? What’s the risk of impermanent loss? One small oversight here could mean losing everything.

This constant pressure just leads to burnout and mistakes. You might miss out on a killer opportunity because you were asleep, or you might rush into a risky new protocol just to chase a high number. For most of us with actual lives and jobs outside of crypto, this hands-on approach just doesn't scale. It turns what should be a passive income strategy into a high-stress, active trading nightmare.

The real problem is that human attention doesn't scale. While you're busy analyzing one opportunity, hundreds of others are changing. Automation fixes this by basically giving you a team of digital analysts working for you 24/7.

The bottom line is that the market's complexity has grown way faster than our ability to keep up with it manually. This gap created a huge need for something better—a system that could do all the heavy lifting of discovery and analysis, around the clock, without human error. This is exactly the problem that automated APY discovery was built to solve.

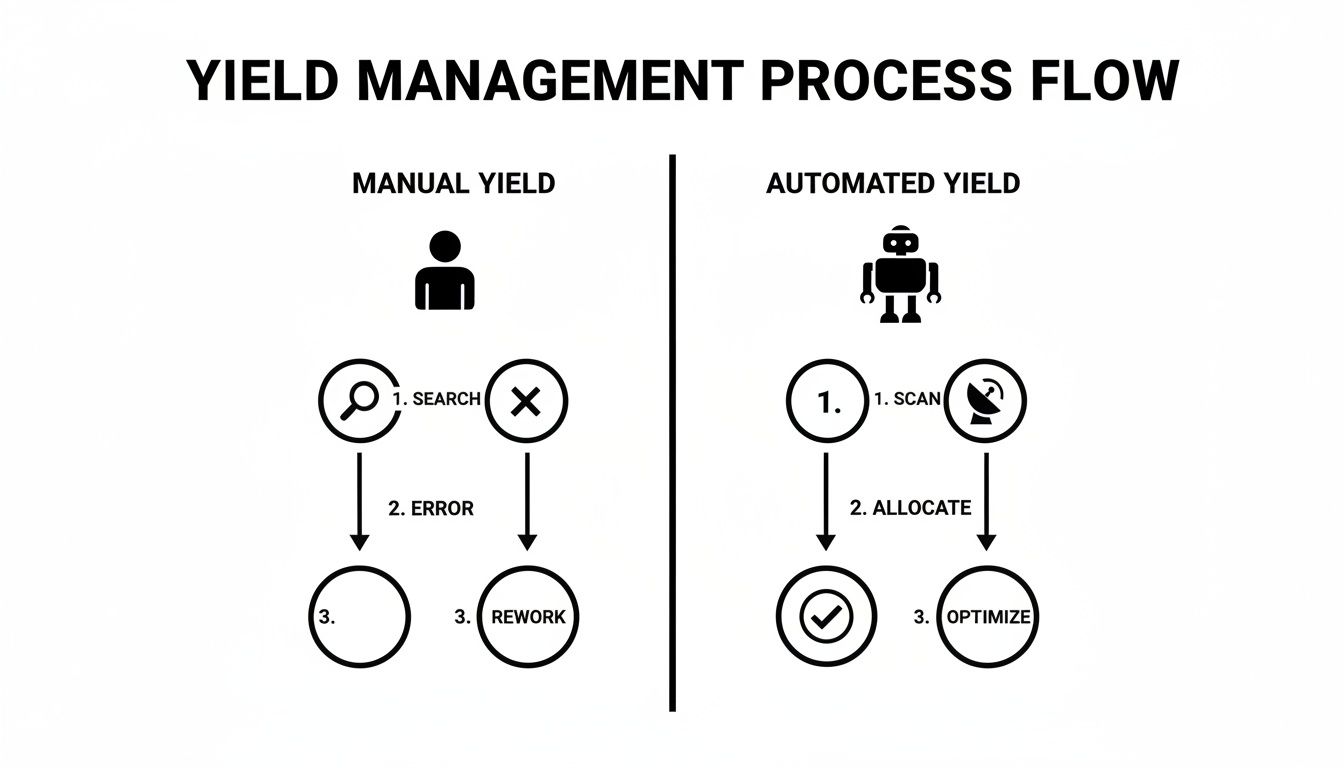

To really see the difference, let’s break down the two approaches side-by-side.

Manual vs Automated Yield Hunting at a Glance

Aspect | Manual Yield Hunting | Automated APY Discovery |

|---|---|---|

Effort | Constant, hands-on monitoring required. | Set it and forget it. The system works for you. |

Speed | Slow. Limited by human reaction time. | Instantaneous. Reacts to market changes in real-time. |

Coverage | Limited to a few protocols you can track. | Scans hundreds of opportunities across the ecosystem. |

Risk Analysis | Relies on individual expertise; prone to error. | Uses data-driven models to assess risk consistently. |

Efficiency | High transaction costs from frequent manual moves. | Optimizes for gas fees and timing. |

Scalability | Doesn't scale. More capital means more work. | Scales effortlessly. Handles any amount of capital. |

As you can see, it's not even a fair fight. Automation takes a process that’s demanding and inefficient and turns it into a powerful, passive strategy. It’s less about working harder and more about working smarter.

How AI Agents Find and Vet Yield Opportunities

Behind every good automated APY platform, there's a powerful AI engine working 24/7. But "AI engine" can feel a bit like a black box. In reality, the process is incredibly logical—think of it as a team of hyper-specialized financial experts working in perfect sync.

To really get what's going on under the hood, let's break this AI agent down into its three core jobs: the Scout, the Analyst, and the Strategist.

This system takes what used to be a chaotic, manual, and often error-prone scavenger hunt and turns it into a streamlined, data-driven operation.

As you can see, it’s a night-and-day difference. We're swapping out endless searching and guesswork for systematic scanning and precise, optimized decisions.

The Scout: Constantly Searching for New Ground

First up is the Scout. Its one and only job is to relentlessly scan the entire DeFi ecosystem for potential sources of yield. Think of it as a digital explorer charting new territory. The Scout never sleeps, constantly monitoring a vast ocean of data to find both established protocols and brand-new opportunities the moment they surface.

The Scout pulls information from a ton of different places:

On-Chain Data: It reads blockchain transactions directly to see where capital is flowing, which protocols are gaining steam, and what new smart contracts are being deployed.

Protocol APIs: It plugs into the data feeds of hundreds of DeFi platforms to get real-time APY figures, liquidity levels, and lending rates.

Social Sentiment Feeds: It even keeps an eye on developer communities and social media channels to get a feel for a project's reputation and developer activity—often an early sign of its health.

This constant discovery process ensures no stone is left unturned. While a human might keep track of ten or twenty protocols, the Scout has its eyes on hundreds at the same time.

The Analyst: Vetting Every Opportunity

Once the Scout flags a potential opportunity, it gets handed off to the Analyst. This is where the real due diligence happens. The Analyst's role is to be the ultimate skeptic, putting every potential yield source under a microscope to separate the promising from the perilous. It doesn't just glance at the advertised APY; it digs way deeper.

The Analyst rigorously evaluates each protocol against a multi-point checklist focused on safety and sustainability. Key evaluation criteria include:

Smart Contract Audits: Has the protocol been audited by reputable security firms? The Analyst hunts for audit reports and immediately flags any unaudited or poorly audited contracts as high-risk.

Historical Performance: It crunches past APY data to see how stable the yield has been. A protocol with a wildly fluctuating APY is treated with a lot more caution than one with a consistent track record.

Protocol Security: The Analyst looks at the protocol’s overall security posture, checking things like the team's anonymity, the quality of its documentation, and its history of any past exploits.

This is the critical vetting process that manages risk. For a deep dive into how platforms like Yield Seeker apply these principles, check out our guide on choosing a secure yield optimization protocol.

The Strategist: Making Data-Driven Decisions

Finally, opportunities that pass the Analyst’s tough inspection are sent to the Strategist. This is the decision-making brain of the whole operation. The Strategist’s goal isn’t just to find the highest number but to build a balanced, risk-adjusted portfolio. For anyone wanting to truly grasp the mechanics, a good understanding artificial intelligence in business provides a solid foundation.

The Strategist doesn’t just chase returns; it manages risk. It creates a dynamic model that weighs potential yield against dozens of risk factors, from market volatility to protocol liquidity, to make the smartest allocation decision at any given moment.

This is where the true power of automated APY discovery really shines. The DeFi lending sector, with around $75 billion in total value locked, showed just how necessary this kind of automation is. AI-powered tools now handle complex tasks like liquidity rebalancing and dynamic interest rate adjustments—work that once took entire teams.

The Strategist is always re-evaluating its decisions, ready to shift capital in seconds if a better, safer opportunity pops up or if the market suddenly changes.

Managing Risk in an Automated DeFi World

Let's be real: automation is a game-changer for finding yield, but it's not a magic shield that makes all the dangers of DeFi vanish. The space is still very much the Wild West, and anyone who tells you otherwise is selling something. Understanding these risks is step one to protecting your capital. This is where a truly smart automated APY discovery platform shows its value—not just in finding the highest numbers, but by obsessively managing the dangers that come with them.

Chasing the absolute highest APY is a classic rookie mistake. The real pros know the goal is to lock in the best risk-adjusted APY. That means balancing the juicy potential returns with a cold, hard look at what could go wrong.

The Three Core Risks in DeFi

Before we talk solutions, you need to know what you're up against when you put your stablecoins to work. The threats are complex, but they usually boil down to three main categories.

Smart Contract Vulnerabilities: Every single DeFi protocol runs on smart contracts—just lines of code on the blockchain. If there's a bug or a clever exploit in that code, hackers can drain funds. Think of it like a hidden flaw in a bank vault's design that nobody noticed until it was too late.

Protocol Exploits: This is a bit bigger than a single code bug. It involves manipulating a protocol's financial logic, like using a massive flash loan to trick an oracle into reporting a bad price. It's less about breaking the code and more about bending the system's rules in ways the creators never intended.

Economic Risks: These are the market-driven dangers. The big one is a de-pegging event, where a stablecoin suddenly loses its $1.00 peg. Another classic is a "bank run" scenario, where a liquidity pool gets drained so fast that you can't get your funds out in time.

Without a dedicated system watching your back, an individual investor is left completely exposed to these threats 24/7.

How Automation Fights Back

A powerful automated APY discovery system isn't just an offensive tool for hunting yield; it's a defensive shield with built-in safeguards. It leverages technology to stay ahead of threats in a way no human ever could. It’s like having an always-on security team for your capital.

This is done through a few key defensive layers. The table below breaks down the common threats and how a good automated platform actively counters them.

Risk Type | Description | Automated Mitigation Tactic |

|---|---|---|

Smart Contract Bug | A flaw in the protocol's code that can be exploited to steal funds. | Automatically checks for security audits from top firms. Unaudiated protocols are flagged or avoided. |

Protocol Exploit | Manipulating the economic logic of a protocol, often with flash loans. | Constantly monitors on-chain data for unusual activity (e.g., strange transaction volumes) and can trigger an automatic withdrawal. |

"Bank Run" | A rapid withdrawal of liquidity, leaving users unable to get their funds out. | Spreads capital across many different vetted protocols, so a failure in one doesn't wipe out the entire portfolio. |

Stablecoin De-Peg | A stablecoin losing its $1.00 value due to market pressure or instability. | Diversifies holdings across multiple stablecoins and protocols to minimize the impact of a single de-pegging event. |

Ultimately, this defensive posture is built on a simple but powerful principle.

The core idea behind automated risk management is this: assume something can and will go wrong. By diversifying and constantly monitoring, the system is designed to contain the damage of any single point of failure, preserving your capital.

This intelligent approach transforms risk from an overwhelming burden into a manageable part of the equation. To go deeper on this, our guide on the best practices for risk management is a great place to start.

Real-Time Risk Scoring

The most advanced platforms take this a step further with real-time risk scoring. The AI agent continuously assigns a dynamic risk score to every single yield opportunity it finds. This isn't a one-and-done rating; it changes by the second based on live data.

For example, a sudden drop in a protocol's total liquidity or a massive spike in negative chatter on social media could instantly crank up its risk score. The system then uses that score to decide whether to allocate, hold, or pull your funds. This ensures your capital is always positioned in the most favorable risk-reward scenarios, adapting to the market faster than any human could. It's the ultimate in data-driven defense.

To really get why automated APY discovery is a game-changer, you have to look at how DeFi has grown up. The old playbook for finding yield is completely broken today, and it’s all because of a massive shift in how returns are actually made.

The early days, what we all call "DeFi Summer," were a bit of a gold rush. A wild west, even. It was the era of insane, triple-digit APYs that looked too good to be true... because, well, they were.

The Era of "Free Money" Yield

In that first wave, huge returns weren't coming from smart financial strategies. Instead, protocols were basically just printing their own governance tokens and handing them out like candy to attract users. The massive APY you saw was mostly just the perceived value of these tokens, which everyone would immediately dump on the market.

This created a pretty toxic cycle:

High APYs pulled in a ton of cash.

This initial hype pumped the token's price, making the APY look even more ridiculous.

But as everyone sold their rewards to cash out, the token price would inevitably crater.

Once the token collapsed, those triple-digit APYs disappeared overnight. Lots of people were left holding bags of worthless tokens. It was a simple, unsustainable model built on pure hype, not real value.

The old model was like a store giving away its own stock to attract customers. It works for a little while, but eventually, you run out of valuable stock to hand out, and the party's over.

The Switch to Real, Complex Yield

Today's DeFi is a different beast entirely. It’s far more grown-up. The best, most sustainable yields aren't coming from simple token handouts anymore. They're generated by sophisticated, often complicated financial mechanics that you need to be a real expert to understand, let alone track.

Things have changed. During DeFi Summer, protocols dangled triple-digit APYs from token rewards, only for them to vanish when the token price tanked. Now, new ideas have totally changed the game. We have things like Pendle's yield stripping, Term Finance's auction-based lending, and Ethena's market-based fees. These models address the problems that made the old yields so flimsy. This evolution gives us access to much more predictable and lasting yield sources than the old rollercoaster of token incentives. You can get a deeper dive into these kinds of DeFi trends and their impact on Blockchain App Factory.

This shift from simple hype to complex financial engineering has made the market incredibly fragmented. Trying to keep up with all these opportunities manually is basically impossible unless you have a full-time team of analysts. The sheer complexity and speed of this new world set the stage for a new kind of solution. This is where automated APY discovery became not just a nice-to-have, but an essential tool for anyone serious about making their assets work for them in modern DeFi.

Why Market Fragmentation Makes Automation a Necessity

The DeFi space has grown up. We've moved on from the early days of simple, hype-driven yields to a world of complex, sustainable financial mechanics. But this evolution did more than just mature the space—it shattered it into a thousand tiny pieces.

Not too long ago, you could realistically keep tabs on the handful of major players that ran the show. Today? Forget about it. The market is deeply fragmented, and this fragmentation is the single biggest reason why automated APY discovery has become an absolute necessity, not just a nice-to-have.

Think of it like this: a few years ago, shopping for a specific item meant checking three big department stores. Now, imagine sifting through hundreds of specialized online boutiques, each with prices and stock that change by the minute. Sure, you have more choice, but finding the best deal becomes an overwhelming, full-time job. That's exactly what's happened in DeFi.

From Market Dominance to a Distributed Ecosystem

The old power structure has completely dissolved. Just a few years back, a small club of protocols controlled almost everything. Protocols like Uniswap, Curve, and PancakeSwap used to account for roughly 75% of all decentralized exchange (DEX) volume. Today, that same market share is spread thinly across at least ten different protocols.

This shift blew the doors open for new, competitive yield sources to pop up everywhere, but it also made manual research a fool's errand. You can get a deeper dive into this trend in the full report on the state of DeFi.

Fragmentation isn't a bad thing; it’s a sign of a healthy, competitive, and innovative ecosystem. For the individual stablecoin holder, though, it creates a massive research burden.

Market fragmentation turns the DeFi landscape into a sprawling, complex web of opportunities. Without automation, you're left trying to untangle this web one thread at a time—a task that's both exhausting and impossible to do well.

An AI agent, however, doesn't see this fragmentation as a problem. It sees a rich dataset just waiting to be analyzed. It can monitor dozens of viable, specialized options at the same time, turning a human's biggest headache into a machine's greatest strength.

Turning Information Overload into Opportunity

As the market gets more spread out, the value of an intelligent aggregator skyrockets. A human investor might be able to effectively track five, maybe ten protocols. An AI agent can track hundreds. It slices through this complexity far more efficiently than any person ever could, sniffing out pockets of high-quality yield that would otherwise go completely unnoticed.

Of course, keeping tabs on all these scattered assets is a challenge in itself, which is why having a solid DeFi portfolio tracker is so crucial for maintaining a clear picture.

This means an AI-driven system can do things that are practically impossible for a human to do manually:

Spot Niche Opportunities: It can uncover yield on smaller, audited protocols that offer great rates but fly under the radar of most manual hunters.

Execute Complex Rotations: It can shuffle capital between multiple platforms in a coordinated dance to capture fleeting rate advantages—a strategy far too complex to pull off by hand.

Aggregate Small Gains: It can capitalize on tiny, short-lived APY differences across the market that, when compounded, add up to significant returns over time.

Ultimately, automation flips the script on market fragmentation, turning a paralyzing challenge into a powerful advantage. It cuts through the noise, connects the dots between scattered platforms, and builds a cohesive strategy out of a chaotic environment. It ensures you’re always positioned to capture the best risk-adjusted returns available, wherever they might be.

Putting Automated Yield to Work with Yield Seeker

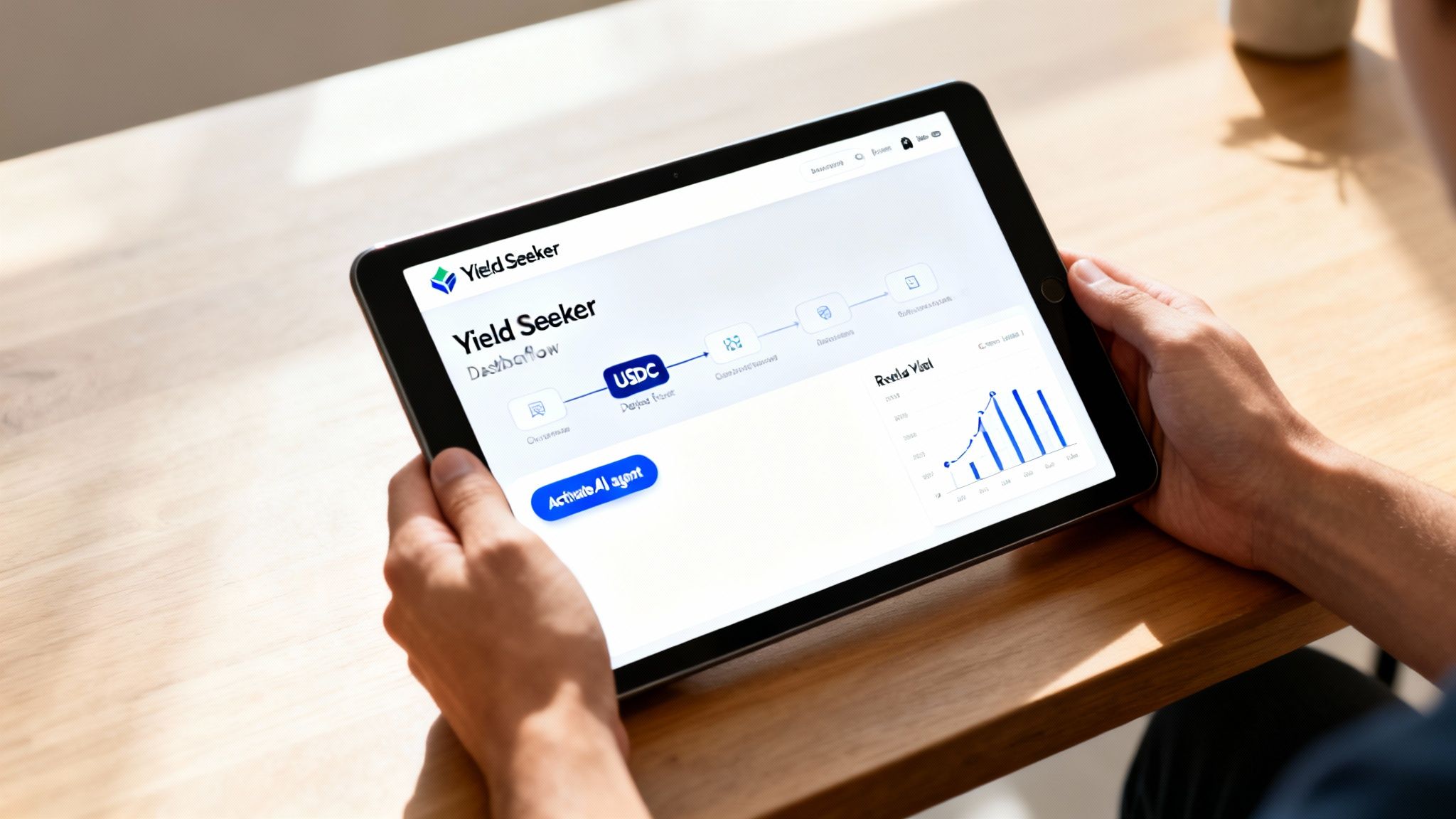

Okay, theory is great, but putting that automated APY discovery to work for your own portfolio is what really counts. Making the jump from hunting for yield by hand to letting an AI agent take over should be a relief, not another headache. With Yield Seeker, we've designed the whole experience to be direct, transparent, and fast—you can have your own AI-powered agent up and running in a few minutes.

The idea is to get rid of all the friction that’s kept most people on the sidelines of DeFi. Forget juggling a dozen browser tabs, managing multiple wallets, or trying to make sense of confusing protocol interfaces. Instead, you get a single, clean platform that does all the heavy lifting for you: the discovery, the analysis, and the execution.

Your Simple Onboarding Journey

Getting started is a quick three-step process that takes you from signing up to earning without breaking a sweat. We’ve obsessed over making the user experience friendly, so even if DeFi is new to you, you’ll feel like you’re in the driver’s seat.

Create Your Account: The setup is quick and secure. Just connect your wallet to the platform and you’ll land on your personal dashboard where you can watch everything happen.

Deposit USDC: You can get started with as little as $10 in USDC on the Base chain. This low entry point lets you kick the tires and see the system work its magic before committing more capital.

Activate Your AI Agent: One click is all it takes. This deploys your personal AI agent, which instantly starts scanning the market, sizing up opportunities, and putting your USDC to work in the best risk-adjusted yield sources it finds.

That’s it—your job is done. The AI agent takes over from there, working 24/7 to constantly optimize your positions for the best possible returns while keeping an eye on risk.

A Dashboard Built for Clarity and Control

True automated APY discovery can't be a "black box." You need to see what's happening to trust the system. The Yield Seeker dashboard gives you a clean, real-time look at your earnings and strategy.

Here’s a snapshot of the main dashboard. It clearly lays out your total balance, earnings over time, and the current net APY your agent is pulling in.

This single view means you always know how your portfolio is doing, no need to jump over to other tools or trackers.

For those who like to peek under the hood, the platform also has a built-in terminal. It gives you a more detailed view of your agent's decisions and the specific protocols it’s using, blending simplicity for beginners with the depth that experienced users appreciate.

Yield Seeker is built on a simple principle: your capital is always yours. We designed the platform for complete user control and flexibility.

This idea shows up in two key policies that make a real difference:

No Lockups: Your funds are never stuck in a rigid contract. You have full control and can get to your capital whenever you want.

No Withdrawal Fees: You can move your money in and out of the platform at any time without getting hit with penalties or fees from us.

These features make sure that even though the yield generation is automated, you never give up your liquidity or control. It’s this blend of effortless automation and user power that makes sophisticated DeFi genuinely accessible to everyone, from busy professionals to crypto veterans looking to sharpen their edge.

Got Questions? We've Got Answers

Jumping into automated yield might bring up a few questions. That's totally normal. Here’s a breakdown of the most common things people ask, so you can see how platforms like Yield Seeker work and why we put your peace of mind first.

How Does The AI Figure Out My Risk Profile?

It's not just a one-and-done setting. Think of it as an ongoing conversation between you and your AI agent.

When you first sign up, a quick questionnaire gives the agent a starting point for your risk tolerance. From there, it pays attention to how you interact with the platform and the kinds of strategies that catch your eye.

But you’re always in the driver's seat. If you want to get more hands-on, the advanced settings let you dial things in perfectly. You can:

Limit exposure to brand-new protocols that don't have a long track record.

Tell it to prioritize strategies with a history of stability over those chasing the absolute highest (and riskiest) APY.

Completely exclude certain types of assets or protocols you're not comfortable with.

This mix of initial setup and continuous learning ensures the strategy your agent runs is a perfect match for your financial goals.

Are All My Funds Sitting In One Smart Contract?

Absolutely not. That would be like putting all your eggs in one basket—a huge no-go in both traditional finance and DeFi. Sticking everything in a single protocol creates a massive single point of failure.

A core principle of smart automated APY discovery is diversification.

Your money is spread across a carefully selected portfolio of DeFi protocols that have all been vetted and audited. This is fundamental to managing risk. It means if one protocol hits a snag—whether it’s a bug, an exploit, or some other issue—the impact on your overall capital is kept to a minimum.

Can I Get My Money Out Whenever I Want?

Yes, 100%. We believe your money should always be your money. Unlike old-school financial products or even some DeFi protocols that lock you in for a fixed term, platforms like Yield Seeker are built for flexibility.

There are no lockup periods and no penalties for taking your money out. Whenever you need to make a withdrawal, just initiate it. The system automatically rebalances its positions to get your funds back to you, plain and simple.

Our philosophy is straightforward: the yield generation is automated, but the control over your capital always stays with you. This commitment to liquidity means you can react to market changes or personal needs without being stuck.

What Happens To My Yield If The Market Goes Crazy?

When things get choppy, the AI agent’s top priority flips from maximizing yield to protecting your capital. It's designed to spot market turbulence by analyzing on-chain data, social media sentiment, and a bunch of other signals.

If it detects high-risk conditions, the system automatically starts de-risking your portfolio. It will shift funds out of higher-risk, variable-rate strategies and into more stable, lower-yield options. This usually means moving capital into safer bets like overcollateralized lending pools until the storm passes and it's safe to chase higher yields again.

Ready to stop hunting for yield and start earning smarter? Yield Seeker puts a personalized AI agent to work for your stablecoins. Get started in minutes and see what automated, risk-aware APY can do for you. Start earning with your AI agent today.