Think of it this way: your stablecoins are employees.

In a traditional savings account, they’re doing a single, slow, repetitive task for pocket change. Capital-efficient DeFi is like upgrading your factory floor with AI-driven robots that let each employee work on multiple production lines at once. The output doesn't just increase—it explodes.

This whole approach is born from a frustration every crypto user feels at some point. It’s painful watching your stablecoins get eaten away by inflation in a high-yield world. But jumping into DeFi can feel like trying to pilot a spaceship with no training. The biggest risk? Holding "lazy assets"—money that's just sitting there, doing nothing. That's a massive opportunity cost.

The core idea is simple: put your money to work. Instead of just holding, you deploy your assets into protocols that generate yield, trading fees, or other rewards. The game shifts from just stacking coins to making those coins work overtime for you.

The main goals here are pretty straightforward:

Bigger Yields: Squeeze more returns out of the same pot of capital than you could with old-school methods.

Kill Opportunity Cost: Make sure your assets are always in the game, minimizing downtime.

Lower the Barrier to Entry: You shouldn't need a massive bankroll to access sophisticated financial strategies.

The Problem With Lazy Money

In both traditional finance and basic crypto HODLing, a ton of capital just sits on the sidelines. A dollar in your savings account? The bank lends out a piece of it and gives you a microscopic cut of the profit. A stablecoin in your wallet earns exactly zero.

Capital-efficient DeFi completely flips that script. It builds systems where your assets can be lent, borrowed, staked, and used for liquidity—sometimes all at once—through a powerful concept called composability. It's like financial lego blocks, where one dollar can suddenly do the job of many.

Let's zoom out. The mind-blowing growth of DeFi is the ultimate proof of this principle in action. What was a tiny $1 billion market back in 2020 has mushroomed into an $83.72 billion powerhouse as of August 2024.

An 83x increase doesn't happen by accident. It happens because DeFi protocols are ruthlessly effective at optimizing capital. For more on this, you can check out these insights on cryptocurrency investment trends.

This incredible efficiency is what makes DeFi so magnetic. It’s a framework that lets anyone graduate from being a passive saver to an active player in a buzzing financial ecosystem. Once you get the hang of these strategies, you can turn your idle capital into a serious engine for growth.

To put it all into perspective, here's a quick comparison of how traditional finance stacks up against a capital-efficient DeFi approach for a simple stablecoin holder.

Capital Efficiency At a Glance: Traditional vs. DeFi

Metric | Traditional Finance (e.g., Savings Account) | Capital-Efficient DeFi |

|---|---|---|

Asset Utilization | Low. Capital is fractionally lent out by a bank. | High. Capital can be simultaneously lent, staked, and used in LPs. |

Yield Potential | Very Low. Typically below inflation rates (~0.46% APY). | High. Varies, but often significantly higher (5% to 20%+ APY). |

Accessibility | High. Easy to open an account. | Moderate. Requires a crypto wallet and some learning. |

Composability | None. Your dollar performs one function. | Core Feature. Assets from one protocol can be used in another. |

Transparency | Opaque. You don't see what the bank does with your money. | Transparent. All transactions are on-chain and verifiable. |

As you can see, the difference is night and day. DeFi is built from the ground up to make every dollar count, offering a level of productivity that legacy systems just can't match.

How to Measure Capital Efficiency Beyond TVL

If you've spent any time in DeFi, you've seen Total Value Locked (TVL) thrown around as the ultimate measure of a protocol's success. But honestly? It's a pretty shallow metric.

Think of it this way: a high TVL is like a packed restaurant. It looks popular, but it doesn't tell you if anyone's actually ordering food or if the business is profitable. A truly capital-efficient DeFi protocol isn't just a vault for idle assets; it’s a bustling kitchen, constantly putting those ingredients to work.

Judging a project solely on TVL is like valuing a company by the cash in its bank account while ignoring revenue, profit, or growth. To get the real story, we need to look at metrics that track activity and productivity. These are the numbers that show how well a protocol turns locked capital into actual economic output.

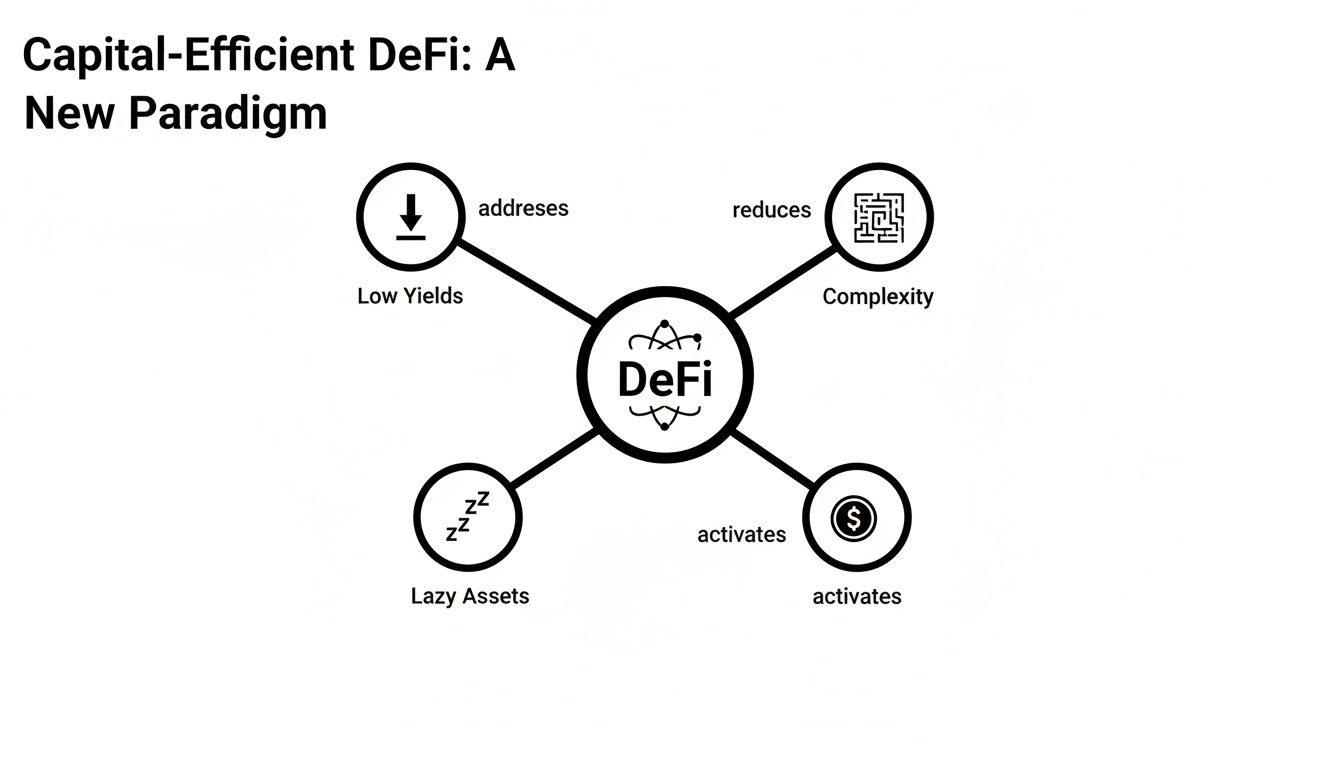

This is the core idea behind capital efficiency—tackling the big DeFi problems like low yields, overwhelming complexity, and "lazy assets" that just sit there doing nothing.

As the diagram shows, efficiency is the solution. It's about designing systems that turn passive holdings into active, yield-generating instruments.

Analyzing TVL Efficiency

A much better metric is TVL Efficiency, which compares a protocol's trading volume to its total value locked. It answers the most important question: how hard is the capital actually working? The formula is simple: Trading Volume / TVL.

Let's imagine two decentralized exchanges (DEXs), each with $100 million in TVL.

DEX A handles $50 million in daily trading volume. Its TVL efficiency is 0.5.

DEX B only manages $10 million in daily trading volume. Its TVL efficiency is just 0.1.

Even with the same TVL, DEX A is five times more efficient. Its liquidity providers are pocketing far more in trading fees from the exact same amount of capital because their assets are being used constantly. It's a dead-simple indicator of a healthier, more productive protocol.

Calculating Yield Per Capital

While TVL efficiency is great for measuring activity, Yield-per-Capital (YPC) gets straight to the point: what's the actual return on my investment? This metric cuts through all the noise and shows you exactly what your assets are earning. Think of it as the ultimate bottom-line performance indicator for any yield strategy.

For instance, if you deposit $1,000 into a liquidity pool and earn $100 in fees and rewards over a year, your YPC is 10%. Simple, clean, and incredibly powerful for comparing different opportunities.

A protocol might flash a sky-high APY, but if that yield is on a tiny, super-volatile asset, your actual dollar return could be next to nothing. YPC keeps you grounded in real, tangible earnings, making it a critical tool for sniffing out truly capital-efficient strategies.

Focusing on YPC helps you sidestep the trap of chasing unsustainable yields and instead prioritize protocols that deliver consistent, real-world value.

Understanding Capital Turnover

Last but not least, there's Capital Turnover. This metric tracks how often assets are used—or "turned over"—within a protocol during a specific period. It's basically the DeFi version of inventory turnover for a retail store.

A high turnover rate is a great sign. It means capital isn't sitting idle; it's actively being lent, borrowed, or traded, generating value for everyone involved.

Take a lending protocol, for example. If it has $10 million in TVL and facilitates $100 million in total loans over a year, its capital turnover is 10x. On average, every single dollar deposited was lent out ten times throughout the year.

A higher turnover rate signals a dynamic and efficient market. It means there’s strong demand for the assets in the protocol, which translates to more fees for lenders and a much more vibrant ecosystem.

Together, these three metrics—TVL efficiency, yield-per-capital, and capital turnover—give you a robust framework for judging any DeFi protocol. They move the conversation beyond the vanity metric of TVL to a much smarter understanding of what's really going on under the hood.

Core Strategies For Making Your Stablecoins Work Overtime

Knowing the theory behind capital efficiency is great, but putting it into practice is where you start seeing real results. The strategies that follow are the engines that power high-performance DeFi, designed to make every single one of your stablecoins pull its weight.

These aren't just abstract ideas; they're battle-tested methods you can use right now to turn idle assets into productive, yield-generating machines. Let's break down the core techniques.

Concentrate Your Liquidity for Higher Fees

One of the biggest game-changers in DeFi has been concentrated liquidity. In the old days of Automated Market Makers (AMMs), when you provided liquidity (LP), your capital was spread thin across an infinite price range—from zero to infinity.

This was wildly inefficient, especially for stablecoin pairs like USDC/USDT that barely budge from their $1.00 peg. Most of your money was just sitting there, waiting for price swings that were never going to happen.

Concentrated liquidity, made famous by protocols like Uniswap V3, lets you pinpoint a tight price range where you want your capital to work. For a stablecoin pair, you might set your range from $0.99 to $1.01.

This one small tweak means 100% of your capital is actively facilitating trades where the action is. As a result, you earn a massively larger slice of the trading fees, sometimes hundreds or even thousands of times more than with the old models.

It's a way to dramatically boost your fee-earning potential without having to deposit a single extra dollar.

Layer Yields With Composability

DeFi's secret sauce is composability—what many call "money legos." It's the idea that the output of one protocol can snap right into another as an input, letting you stack or "layer" multiple yield sources onto the same pile of cash.

Imagine you deposit your stablecoins into a lending protocol. You get back a receipt token (often called an "aToken" or "cToken") that represents your deposit plus the interest it's earning.

Instead of just letting that sit, you can put that receipt token back to work. Here’s a quick example of how it works:

Base Layer: Deposit 1,000 USDC into a lending protocol like Aave to start earning a base APY. You get 1,000 aUSDC back.

Second Layer: Take that aUSDC (which is already earning interest) and drop it into a yield aggregator or another liquidity pool that accepts it. Now you're earning trading fees on top of your lending yield.

Third Layer: Some seriously advanced strategies even let you use that LP position as collateral to borrow another asset, pushing your capital even further.

This layering effect is a cornerstone of capital-efficient DeFi. It lets a single dollar do multiple jobs at once, multiplying its productivity in ways that are simply impossible in traditional finance. If you want to go deeper on this, we've got a whole guide covering the nuances of https://yieldseeker.xyz/yieldseekerblog/stablecoin-yield-farming.

Use Leverage and Borrowing (Carefully)

Borrowing against your assets can be an incredible tool for juicing returns, but you have to handle it with care. The basic play is to use your existing crypto as collateral to borrow more capital, which you then deploy into another yield-generating strategy.

For example, you could park $1,000 of ETH in a lending protocol and borrow $500 in USDC against it. You then take that $500 USDC and put it to work in a high-yield stablecoin farm.

The goal is simple: the yield you earn on the borrowed cash should be way higher than the interest you pay on the loan. This creates a profitable "carry trade" and boosts the overall return on your initial capital. But there's a catch: liquidation risk. If the value of your ETH collateral drops too far, the protocol will automatically sell it to pay back your loan.

Risk management is absolutely non-negotiable here. That means:

Healthy Loan-to-Value (LTV): Don't borrow the max. A lower LTV gives you a bigger cushion against market dips.

Stablecoin Collateral: Borrowing against other stablecoins drastically cuts your liquidation risk compared to using volatile assets.

Set Up Alerts: Use tools to ping you if your position gets close to liquidation so you can add more collateral or pay down the loan.

Leverage can be a powerful amplifier, but it’s a double-edged sword that demands your full attention.

Comparing Stablecoin Capital Efficiency Strategies

To make sense of these options, it helps to see them side-by-side. Each strategy has its own unique profile when it comes to potential returns, complexity, and the risks you're taking on.

Strategy | Mechanism | Efficiency Gain | Risk Profile |

|---|---|---|---|

Concentrated Liquidity | Focuses capital in a narrow price range to capture more trading fees from the same amount of liquidity. | High (100x-1000x+ fee potential) | Medium (Impermanent Loss risk if price moves outside the range) |

Yield Layering | Uses receipt tokens (e.g., aUSDC) from one protocol as input for another, stacking multiple yield sources. | Medium to High (Depends on the number and quality of layers) | Medium (Smart contract risk increases with each new protocol added) |

Leverage & Borrowing | Borrows assets against existing collateral to deploy into additional yield strategies. | Very High (Directly multiplies capital exposure) | High (Liquidation risk if collateral value drops; requires active management) |

Automated Vaults | Smart contracts automatically execute complex strategies, like rebalancing concentrated liquidity positions. | High (Optimizes for efficiency without manual intervention) | Medium (Dependent on the vault's strategy and smart contract security) |

This table isn't exhaustive, but it gives you a solid framework for thinking about which approach fits your goals and risk tolerance. The most advanced users often combine these strategies to create a truly optimized DeFi portfolio.

Unlocking Trapped Value with Liquid Staking

Traditional staking has always presented a classic trade-off for crypto investors. You lock up your assets to earn rewards and help secure the network, but in doing so, you make them completely illiquid. That capital is stuck doing just one job, unable to jump on any of the other opportunities popping up in the fast-moving world of DeFi.

It's like putting your cash into a long-term CD at the bank. Sure, it's earning some interest, but you can't touch it if a better investment comes along. In a market that moves at the speed of crypto, having your capital sidelined means you're almost certainly leaving money on the table. This is the exact opposite of capital-efficient DeFi.

The Power of Liquid Staking Tokens

Liquid staking completely changes the game with a simple but brilliant idea: the Liquid Staking Token (LST). When you stake your crypto through a liquid staking protocol, you get a tokenized receipt back—the LST. This new token represents your claim on the original assets you staked, plus all the rewards they're busy generating.

Think of it like getting a home equity line of credit. You still own your house and it's still appreciating in value, but now you have a liquid line of credit you can use for other things. LSTs work the same way by unlocking the value of your staked capital.

This clever mechanism lets your assets be in two places at once. Your original crypto is still staked, earning rewards and securing the network. At the same time, your LST is a fully functional token that you can trade, lend, or use as collateral anywhere in the DeFi ecosystem.

Doubling Your Capital's Productivity

This is where the real magic happens. By using your LSTs in other DeFi protocols, you transform a single-purpose asset into a multi-tool for generating yield. You no longer have to choose between staking rewards and DeFi yields—you can go after both.

Here are a few common ways people put their LSTs to work:

Providing Liquidity: You can pair your LST with another asset (like ETH or a stablecoin) in a liquidity pool on a decentralized exchange. This lets you earn trading fees on top of your base staking rewards.

Lending and Borrowing: LSTs can be deposited into lending protocols to earn extra interest. Or, you can use them as collateral to borrow other assets for new strategies.

Yield Aggregators: Automated vaults can take your LSTs and run complex, multi-layered strategies to squeeze out the best possible returns, saving you the headache of managing it all yourself.

By letting a single asset generate multiple, independent streams of income, liquid staking has become a cornerstone of modern capital-efficient strategies. It effectively doubles your capital's productivity, turning "trapped" value into an active, wealth-generating force.

The growth here has been nothing short of explosive. The market is projected to skyrocket from $168 million in 2024 to $572 million by 2032, which tells you just how valuable this innovation is. You can dig into the full Intel Market Research on the liquid staking market to see its impressive trajectory.

How AI Automation Is the Next Frontier in DeFi

Let's be real. The strategies we've just gone over—concentrated liquidity, yield layering, and smart leverage—are incredibly powerful. But they all share one giant headache: they are an absolute grind to manage manually.

Trying to juggle all those moving parts is less like investing and more like being a full-time air traffic controller for your own money.

DeFi never sleeps. It's a 24/7 global arena where yields can vaporize in seconds, liquidity pools shift, and golden opportunities pop up while you're offline. For one person to keep up with that? It's not just a challenge; it's a losing battle. This is where the next leap forward in capital-efficient DeFi comes in: AI-driven automation.

This isn't just about making life easier. It's about raw performance. An AI agent can chew through thousands of data points in real-time, tracking interest rates across dozens of protocols, calculating impermanent loss risk, and sniffing out the best fee-generating spots far better than any human ever could.

From Manual Grind to Automated Intelligence

Think of an AI-powered platform as your personal, automated portfolio manager, built from the ground up for stablecoins. It takes all those potent, high-return strategies that normally demand your constant attention and just... does them for you. This is the bridge between sophisticated theory and hands-off, practical results.

Instead of you having to manually tweak your concentrated liquidity range every few hours, an AI agent can watch the trading volume and automatically reposition your capital to stay in that sweet spot. This kind of proactive management means your money is always working as hard as possible, squeezing out every last drop of fee revenue without you being chained to a screen.

The shift is huge, and it opens up advanced DeFi to a whole new crowd.

For Busy Professionals: It’s true "set it and forget it" growth. You get to tap into DeFi's upside without sacrificing your time.

For Newcomers: It acts as a secure on-ramp, stripping away the intimidating complexity and the risk of costly manual mistakes.

For Power Users: It’s a force multiplier. By automating the repetitive grunt work, you can focus on bigger-picture strategy and scale your efforts.

This isn't some far-off sci-fi concept; it's happening right now. Just look at this screenshot from Yield Seeker's dashboard. It gives you a clean, simple view of what the AI agent is doing and how it's performing.

The whole point is to simplify a deeply complex process, showing you the clear earnings data without burying you in technical jargon.

Why AI and DeFi Are a Perfect Match

The synergy here is just undeniable. DeFi is a world of pure, transparent on-chain data. Every transaction, every interest rate, every fee—it’s all public. This creates the perfect digital sandbox for AI models to learn, adapt, and execute strategies with a level of precision that's simply beyond human reach.

By constantly analyzing market conditions, an AI agent can make thousands of micro-adjustments per day, compounding tiny efficiencies into significant long-term gains. It turns the market's volatility from a threat into an opportunity.

This is exactly what's happening in traditional finance. We see real-world examples of how Goldman Sachs is using generative AI turbocharging efficiency in banking. In DeFi, that evolution is happening at light speed.

Platforms built on this idea become the engine for capital efficiency, giving everyday users access to strategies that were once locked away for elite traders. If you're curious about the mechanics, digging into a modern yield optimization protocol shows how these automated systems are engineered to juice returns while keeping risk in check.

Ultimately, AI automation isn’t just another feature. It’s the engine that will power the next wave of accessible, high-performance decentralized finance.

Navigating the Risks of High-Efficiency Strategies

It’s no secret that chasing higher returns in DeFi means stepping into a more complex world of risk. The goal isn't to dodge risk entirely—that’s impossible. It's about getting smart with it, protecting your hard-earned assets while still being in a position to catch the upside.

Many of these high-efficiency strategies depend on multiple protocols working together perfectly. While stacking these "money legos" can boost your potential yield, each new piece you add brings its own unique set of risks to the table. You have to be aware of them.

Smart Contract and Protocol Risk

At the heart of any DeFi strategy, you'll find smart contract code. A single bug or exploit in one protocol can trigger a domino effect, putting everyone's funds on the line. Even protocols that have been thoroughly audited aren't completely bulletproof, which makes choosing where you park your money the most critical first step.

To keep yourself safer, always lean towards protocols with a long, proven history and multiple independent security audits. It's also a good idea to spread your capital across several reputable platforms. That way, a single point of failure won't completely wipe you out. Getting a handle on the fundamental principles of risk and analysis is a huge advantage here.

Impermanent Loss in Liquidity Pools

When you add your funds to a decentralized exchange liquidity pool, especially a concentrated one, you run into something called impermanent loss (IL). This happens when the prices of the assets you’ve pooled change, making their combined value less than if you had just held them in your wallet.

For stablecoin pairs, this risk is pretty low since they rarely drift far from their $1.00 peg. But for pools with more volatile assets, a big price swing outside your chosen range can lead to serious IL, potentially wiping out all the trading fees you've earned and then some.

Key Takeaway: Think of impermanent loss as the opportunity cost of being a liquidity provider. The trading fees are your compensation for taking on this risk, but you have to keep a close eye on it, especially when the market gets choppy.

The Dangers of Liquidation

Leverage is an incredible tool for juicing up your returns, but it brings the very real danger of liquidation. If the value of your collateral dips below a certain point, the lending protocol will automatically sell it off to pay back your loan. That's a permanent loss of your assets.

Managing this requires discipline. Here are a few solid steps to protect your position:

Keep a Low Loan-to-Value (LTV) Ratio: Don't borrow the maximum amount you can. A lower LTV gives you a much bigger cushion to absorb price drops.

Use Stable Collateral: Using stablecoins as collateral is a game-changer. It drastically cuts your liquidation risk compared to using something volatile like ETH or BTC.

Set Up Alerts: Use monitoring tools that ping you when your position gets close to the liquidation threshold. This gives you precious time to add more collateral or pay down the loan.

These are some of the core risks you'll face. For a deeper dive, our guide on the best practices for risk management lays out more actionable steps to help you build a more secure DeFi portfolio.

Still Have Questions About Capital-Efficient DeFi?

Let's clear up some of the common questions people have. It’s important to get these distinctions right before you jump in.

High Yield vs. High Efficiency

This one trips a lot of people up. What's the real difference between a high yield and a strategy that's truly capital efficient? It’s a critical distinction.

A high yield is just a big APY number. It’s often flashy and can be incredibly misleading. That number tells you nothing about the risk you’re taking on, or how hard your money is actually working to generate that return. It might be fueled by unsustainable token emissions or a super-risky strategy on the verge of collapse.

Capital-efficient DeFi, on the other hand, is all about the return you get in relation to the capital and risk involved. It answers a much smarter question: "For every dollar I put in, how much am I getting back, and how safely?" An efficient strategy might show a slightly lower APY than some degen farm, but it could be generating that return with far less capital and much lower risk. That makes it the smarter, more sustainable play.

Is This Too Complicated for Beginners?

Okay, so is capital-efficient DeFi just for the pros? While the mechanics under the hood can get pretty advanced, the answer is a firm no. The whole point of modern platforms is to hide that complexity from you.

Think of it this way: automated, AI-driven platforms act like a co-pilot. They handle all the heavy lifting—the constant monitoring, the tricky rebalancing, and the non-stop risk management. This lets newcomers get all the benefits of sophisticated DeFi strategies without needing a Ph.D. in smart contracts. It’s a simple and secure on-ramp to the advanced stuff.

Do I Need a Ton of Money to Get Started?

This is probably the biggest myth in DeFi: that you need a huge bankroll to even bother. Honestly, that couldn't be further from the truth.

The entire point of capital-efficient DeFi is making the most out of any amount of capital you have. Thanks to low-fee networks like Base, access has been completely blown wide open. You can genuinely get started with as little as $10 and plug your assets into the same powerful strategies the big players use. The playing field has been leveled, and anyone can start building a productive digital asset portfolio.

Ready to put your stablecoins to work without all the manual grind? Join Yield Seeker and let your personalized AI Agent find and manage the best yields for you, on autopilot. Start earning smarter today.