If you’ve ever tried to chase the best yields in DeFi, you know it feels like a full-time job. A lending protocol offering an incredible 12% APY on your stablecoins today might slash it to 5% tomorrow, all while a better opportunity pops up on a completely different platform.

Manually moving your funds around to catch these fleeting peaks is exhausting and, frankly, almost impossible. This is where the old "set and forget" method, often called static yield farming, falls short. You find a decent APY, deposit your funds, and just hope for the best.

But what if your funds could move themselves?

What Is Real-Time APY Optimization and Why It Matters

Imagine your portfolio had a personal financial advisor working for you 24/7—one that could analyze thousands of data points a second and execute trades instantly. That's the essence of real-time APY optimization.

It’s an automated strategy that constantly scans the DeFi landscape to find the highest-yielding, safest opportunities for your stablecoins and moves your capital to capture them. Think of it like a smart irrigation system for your garden that redirects water to the thirstiest plants precisely when they need it, ensuring the best possible harvest. It's a dynamic, hands-off approach that keeps your money working as hard as possible.

This isn't just about convenience; it's about performance. High-yield opportunities in DeFi can be incredibly short-lived, sometimes lasting only a few hours or even minutes. An automated system can:

Monitor countless DeFi protocols across multiple blockchains at once.

Analyze APYs, liquidity, and risk factors in real time.

Instantly execute transactions to shift your funds, capitalizing on peak yields before they vanish.

This is a fundamental shift from passively earning to actively optimizing.

Static vs. Dynamic: A Tale of Two Strategies

The performance gap between static and dynamic strategies is massive. In the fast-paced world of DeFi, real-time optimizers have become a game-changer for stablecoin holders. By late 2025, the total value locked (TVL) in stablecoin yield strategies shot past $150 billion.

Crucially, automated optimizers captured 28% higher average APYs than static positions. For USDC depositors, that translated to an extra 4.2% in annualized returns. That’s not pocket change.

This gap underscores why automation is no longer a luxury but a necessity for anyone serious about generating passive income in crypto.

Before we go deeper, if you're new to the concept, our guide on what Annual Percentage Yield is breaks down exactly how this core metric works. It's also worth checking out explainers on DeFi yield optimization with aggregators to see how different platforms pull this off.

To make the difference crystal clear, let's break down how the old manual approach stacks up against modern, real-time optimization.

Static Yield Farming vs Real-Time APY Optimization

Feature | Static Yield Farming (Manual) | Real-Time APY Optimization (Automated) |

|---|---|---|

Strategy | "Set and forget." Deposit into one protocol and hope for the best. | Dynamic and adaptive. Constantly moves funds to the best opportunities. |

Speed | Slow and manual. Requires hours of research and transaction delays. | Instantaneous. Executes trades in seconds, 24/7. |

Opportunity | Misses short-lived yield spikes. Limited to a few known protocols. | Captures fleeting high-yield windows. Scans the entire DeFi market. |

Risk | Concentrated in a single protocol. Slow to react to market changes. | Diversified and risk-aware. Can exit risky positions automatically. |

Returns | Often leaves money on the table. Lower, less consistent APYs. | Maximizes potential returns by always being in the optimal position. |

Effort | High effort for monitoring; low effort for execution (infrequent). | Low effort. The system does all the heavy lifting for you. |

As you can see, while static farming is simple, it's just not built for the speed and volatility of today's DeFi market. Real-time optimization gives you a powerful edge, turning a reactive process into a proactive, intelligent strategy that works for you around the clock.

The Four Pillars of Automated Yield Generation

So, how do automated systems manage to pull off consistently better returns? It helps to think of it like a high-performance race car—its power isn’t just from the engine, but from a whole system of critical parts working together perfectly. For real-time APY optimization, that engine is built on four distinct pillars.

Breaking these down shows you the powerful mechanics that turn a simple deposit into a smart, dynamic earning strategy. This system is always on, working behind the scenes in a way no human investor could ever keep up with manually.

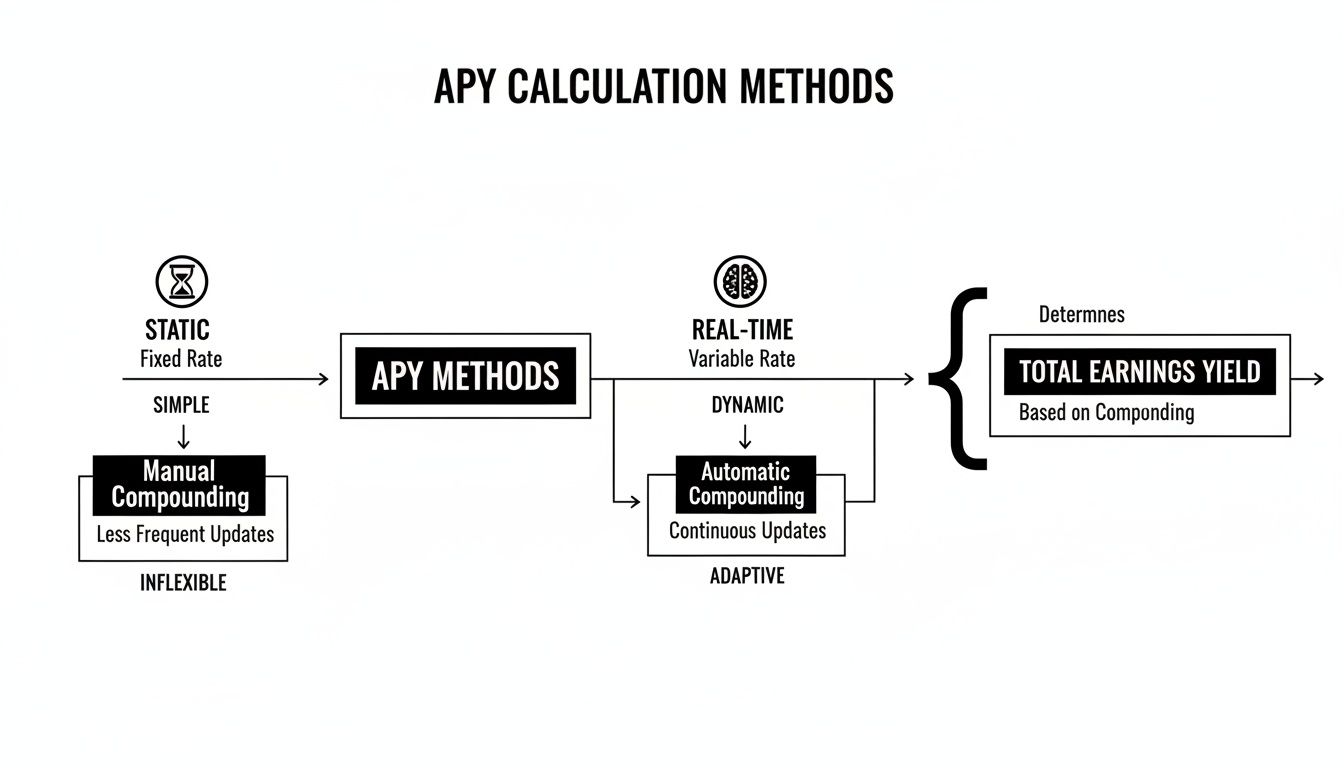

This chart really drives home the shift from the old, static way of doing things to a dynamic, real-time approach.

You can see how static methods are just a snapshot in time, while a real-time system is constantly learning and adjusting its course.

Pillar 1: High-Fidelity Data Feeds

It all starts with information. Think of high-fidelity data feeds as the system's eyes and ears, constantly scanning the entire DeFi ecosystem for signals. These aren't just basic price tickers; they're pulling in massive streams of data on everything that could possibly affect your returns.

This includes stuff like:

Real-time APYs from hundreds of different lending pools and protocols.

Liquidity levels to make sure funds can actually be moved without getting stuck or causing slippage.

Transaction costs (gas fees), because a move is only profitable if the gas doesn't eat up all the gains.

Protocol health metrics like Total Value Locked (TVL) and recent transaction volume.

Without clean, comprehensive, and up-to-the-second data, any decision is just a guess. This constant flow of information is literally the fuel for the entire optimization engine.

Pillar 2: Intelligent Strategy Selection

Once the data is in, the AI brain of the system gets to work. This is where intelligent strategy selection comes in. It processes that flood of information to pinpoint the most promising opportunities out there. But it's way more than just grabbing the highest APY it sees.

The AI analyzes patterns, predicts how quickly a yield might drop off, and compares dozens of potential moves all at once.

For example, a protocol might be flashing a juicy 15% APY, but the AI might see that its liquidity is thin and the yield has been super volatile. It might decide that's too risky or won't last. Instead, it could opt for a more stable 11.5% APY in a different protocol with a much better long-term outlook. That's the kind of deep analysis that separates a truly smart system from a simple "yield chasing" bot.

Pillar 3: Risk-Aware Capital Allocation

Finding a great opportunity is only half the job. The next step, risk-aware capital allocation, is about deciding exactly how to act on it. This is the system's logic center, constantly balancing the aggressive hunt for yield with smart risk management.

This part acts like a sophisticated portfolio manager. It’s not going to throw all your eggs in one basket, no matter how shiny that basket looks. Instead, it spreads capital across multiple vetted protocols to keep risk in check.

Before executing any transaction, it asks some critical questions:

How much capital should we move to this new opportunity?

What's the actual risk profile of the protocol we're moving into?

Does this move fit with our overall goal of a diversified portfolio?

This ensures that the chase for high returns doesn't come at the expense of your principal. To get a better sense of how funds are moved, check out our deeper dive on algorithmic yield routing.

Pillar 4: Low-Latency Execution

The final piece of the puzzle is speed. Once the best strategy is picked and the risk is weighed, low-latency execution takes over. This is the component that actually makes the move, executing transactions with machine-level speed and precision.

In DeFi, the best opportunities can disappear in seconds. A human investor might spot a high APY, spend a few minutes connecting their wallet and confirming transactions, only to find the rate has already tanked. An automated system, on the other hand, can execute a complex chain of transactions in the time it takes you to click a single button.

This speed is the ultimate edge. It ensures the opportunity the AI found is captured before it's gone. Together, these four pillars create a powerful, self-correcting loop that is always working to get you the best possible risk-adjusted returns.

Putting Your Earnings on Autopilot with an AI Agent

So, we've talked about the mechanics behind real-time APY optimization, but how does this actually work for you? Let's walk through how a platform like Yield Seeker takes all that complex theory and turns it into a simple, hands-off experience. You don’t need to be a DeFi degen or a coder to put this tech to work.

It all starts with a simple deposit. You can get going with as little as $10 in USDC, which is awesome because it means these advanced strategies aren't just for whales. The moment your funds land, your personal AI Agent springs into action. Think of it as your new digital portfolio manager, working for you 24/7.

This agent is where the magic happens. It’s a powerful combo of AI, smart contracts, and high-speed execution all wrapped into one secure and efficient earning machine built just for you.

Your Personal AI Agent at Work

Imagine having an analyst who never sleeps, never gets tired, and is constantly scanning the entire DeFi market for the best risk-adjusted returns for your money. That's your AI Agent.

Its main job is to make sure your capital is always in the best possible spot. This isn't some "black box" where your money disappears and you just have to trust it's working. Platforms like Yield Seeker are built on transparency. You get a clean, easy-to-read dashboard that shows you exactly what your agent is doing and how it's performing.

Here’s a look at how that might appear on your phone, breaking down how a deposit is put to work across different opportunities.

This kind of visual breakdown makes it crystal clear. You can see precisely where your funds are deployed and the returns they're generating at any given moment.

The Power of Set-It-and-Forget-It Execution

The entire process is designed to be dead simple. After your initial deposit, you’re done. The system takes over from there.

Always Watching: The AI scans hundreds of vetted protocols every second, crunching the numbers on APYs, liquidity levels, and risk factors.

Spotting the Next Move: When it finds a better yield opportunity, it runs the numbers, weighing potential gains against transaction costs and risks.

Making the Switch: If the move is profitable and passes the safety checks, smart contracts automatically shift your funds to the new protocol. No clicks needed.

Compounding on Autopilot: Your earnings are automatically reinvested, putting the power of compounding to work and accelerating your growth without you lifting a finger.

This cycle runs on a constant loop, ensuring your capital is never just sitting around in a low-performing vault. This active management is what truly sets it apart from the old "park and pray" manual approach. If you want to dive deeper into the tech that makes this possible, check out our guide on how an AI yield aggregator really works.

Just How Much of a Difference Does Automation Make?

This isn't just theory; the performance data speaks for itself. Real-time APY optimization has historically delivered some serious gains in DeFi. In fact, platforms automating across protocols have boosted user returns by 35% on average from 2022-2025.

The secret sauce is speed. Low-latency data feeds (under 50ms) have been shown to slash decision-making lag by a staggering 92%. This speed prevented an estimated $1.4 billion in opportunity costs during the 2024 summer lull when APYs for static holders cratered 40% practically overnight.

This rapid-fire response allows automated systems to sidestep sudden yield drops and jump on those fleeting APY spikes that a human investor would almost certainly miss. Ultimately, platforms like Yield Seeker harness these complex market dynamics and package them into a simple, automated, and incredibly powerful tool for growing your crypto.

So, what does all this tech actually do for your wallet and your sanity? Once you get past the mechanics, the real-world perks of using a real-time APY optimization platform are massive. It’s not just about chasing bigger numbers—it's about finding smarter, more stable growth without all the effort and stress.

Let's break down the four key ways automated strategies completely change the game for earning yield in DeFi.

Maximize Your Returns

The most obvious win is, of course, better earnings. An automated system is always on, constantly shifting your capital into the highest-yielding, risk-vetted opportunities it can find. It snags those fleeting APY spikes that you'd almost certainly miss doing it by hand, making sure your funds are always working as hard as possible.

This constant optimization also kicks compounding into a higher gear. Instead of earnings just sitting there, they’re immediately put back to work in the best available positions. This creates a snowball effect that really speeds up your portfolio's growth over time. We've seen this movie before in traditional finance, where technology gave some players a huge performance advantage.

Think about it: when high-frequency trading first hit the scene, shaving latency from 120ms down to 25ms boosted equity returns by 15-20%. We're seeing the same thing in DeFi with stablecoin yields, which have jumped by 24% since 2023 thanks to similar speed advantages. At Yield Seeker, our projections for the Base network launch show users could hit a 14.3% peak APY in Q1 2026, blowing past the 9.5% benchmark for static strategies. To get a better sense of this, you can explore more insights about real-time data in financial markets and see just how much speed matters.

To put this in perspective, let’s look at a simple model comparing a static "set-and-forget" approach versus a dynamic, optimized strategy over one year.

Projected Annual Gains: Static vs Optimized Strategy

Principal Investment | Static APY (e.g., 7%) | Optimized APY (e.g., 11.2%) | Additional Annual Earnings |

|---|---|---|---|

$1,000 | $70.00 | $112.00 | $42.00 |

$5,000 | $350.00 | $560.00 | $210.00 |

$10,000 | $700.00 | $1,120.00 | $420.00 |

$25,000 | $1,750.00 | $2,800.00 | $1,050.00 |

$50,000 | $3,500.00 | $5,600.00 | $2,100.00 |

As you can see, the difference isn't trivial. The "Additional Annual Earnings" column highlights the extra money your capital could be making, all because the system is constantly finding and capturing better rates.

Save Your Most Valuable Asset: Time

Trying to manage a DeFi portfolio by yourself is a grind. It means spending countless hours digging into protocols, comparing APYs that change by the minute, reading security audits, watching gas fees, and jumping between different platforms to make trades.

An automated system just gets rid of all that.

By handing off the research, monitoring, and execution to an AI agent, you get back dozens of hours every month. You're free to think about big-picture strategy or, better yet, just enjoy the passive income without the headache of active management. The platform does the heavy lifting, 24/7.

Reduce Emotional Decision-Making

Let’s be honest, our own psychology is often the biggest enemy of good investing. FOMO (fear of missing out) makes us chase crazy, unsustainable yields, while panic-selling during a market dip is a surefire way to lock in losses. These reactions are just part of being human.

AI-driven platforms don't have feelings. They run on pure data and logic, executing strategies based on a pre-set playbook designed for the best risk-adjusted returns. This yanks emotional bias out of the equation, leading to much more consistent and disciplined management. By sticking to the plan, the system sidesteps common human errors and keeps your strategy on course.

Enhance Your Risk Management

Finally, real-time optimization brings a much smarter layer of risk management to the table. When you're managing things manually, it’s easy to end up with all your capital in just one or two protocols. That creates a single point of failure—if that protocol gets hacked or hits a snag, your whole investment is on the line.

Automated platforms are built to avoid this trap:

Built-in Diversification: The AI automatically spreads your capital across a whole portfolio of carefully vetted and constantly monitored DeFi protocols.

Rapid Response: If a protocol starts flashing warning signs—like a sudden liquidity drop or weird on-chain activity—the system can pull your funds out way faster than any human ever could.

This combination of smart diversification and lightning-fast execution makes for a much more resilient portfolio. It’s a proactive defense that protects your principal while still hunting for those top-tier yields—something that’s practically impossible to do on your own.

Navigating Security and Risks in Automated DeFi

Trust is everything in DeFi. With all the talk of high returns, it's only natural to ask: "Is my money actually safe?" It's a critical question, and any serious platform for real-time APY optimization needs a solid answer. The truth is, DeFi has its risks, but a smart, multi-layered security plan can cut them down dramatically.

It’s not about pretending risks don't exist. It’s about building a system that intelligently manages and minimizes them at every single turn. This means moving beyond simple automation to create a framework where security is the foundation, not just an add-on.

A Fortified Garden, Not the Wild West

The biggest fear is that an AI will just blindly chase the highest APY, accidentally dumping your funds into some brand-new, unaudited, or even malicious protocol. That’s precisely why a top-tier system works within a "fortified garden"—a curated, pre-vetted list of DeFi protocols the AI is allowed to interact with. Nothing more, nothing less.

This vetting process is the first and most vital line of defense. Before any protocol even gets considered, it has to go through a tough evaluation:

Smart Contract Audits: We pore over security audits from reputable firms to spot potential vulnerabilities and make sure they’ve been fixed.

Protocol History and TVL: We look at the protocol's track record, how long it's been around, and its total value locked (TVL) as a signal of community trust and stability.

Team and Community Reputation: We do our homework on the development team's background and the overall health of its community.

Only the protocols that pass this exhaustive checklist make it onto the whitelist. This ensures the AI only plays in battle-tested environments.

Continuous Monitoring and Smart Diversification

Security doesn't just stop after the initial checkup. DeFi moves fast, so a static whitelist is never enough. The second layer of defense is continuous on-chain monitoring. The system is always watching for red flags in real-time.

For example, if a whitelisted protocol suddenly sees a massive, unexplained drop in liquidity or weird transaction patterns, the AI can be programmed to automatically pull your funds out to a safer spot until things are clear. This kind of rapid response is a huge advantage over trying to manage everything manually.

On top of that, a core principle here is intelligent diversification. The AI is specifically designed to never overexpose your capital to a single protocol. By spreading funds across multiple vetted opportunities, the system cushions the impact if any one protocol hits a snag.

You Are Always in Control

At the end of the day, the best security framework is one that puts you, the user, in the driver's seat. We achieve this through a non-custodial model. When you deposit funds into a platform like Yield Seeker, they are managed by a smart contract that you control. The platform never actually takes ownership of your assets.

This means you always have the final say. You can withdraw your funds whenever you want, with no lockup periods or sneaky exit fees. This blend of user control, tough protocol vetting, and constant monitoring creates a much safer DeFi experience, letting you tap into real-time APY optimization with a whole lot more peace of mind.

Got Questions? Let's Talk Real-Time APY.

Stepping into automated finance, even with a solid grasp of how it works, can still feel like a big leap. It's totally normal to have a few lingering questions. So, I've put together the most common ones we hear from both DeFi pros and newcomers alike to give you some clear, straight answers.

Think of this as your final sanity check. We'll clear up any haze around how real-time APY optimization actually works, who it’s for, and how platforms like Yield Seeker keep your funds safe while chasing performance.

Is This Just a Game for Whales and Big Investors?

Absolutely not. In fact, one of the biggest wins in this space is making these powerful tools accessible to everyone. Modern platforms are built from the ground up to be inclusive, letting you get started with as little as $10.

The AI and automation engines are just as sharp with a small deposit as they are with a massive institutional portfolio. The whole point is to give everyday investors access to the kind of strategies that used to be locked away in the world of hedge funds and professional trading.

And don't forget the magic of compounding—even a modest starting point can snowball into something substantial when it's actively managed.

How Does the AI Know Which DeFi Protocols Are Safe to Use?

This is the bedrock of the whole system: safety first. The AI isn't just let loose to roam the wild west of DeFi. Instead, it operates inside a secure, walled garden of protocols that have been rigorously vetted and pre-approved by our team.

Before any protocol makes it onto our "safe list," it has to pass a multi-stage evaluation that blends automated analysis with actual human expert review. We're looking at things like:

Audit History: Has the protocol been audited by top-tier security firms? Were vulnerabilities found and, more importantly, fixed?

Track Record: We dig into its operational history, total value locked (TVL), and on-chain activity. A long, stable history builds trust.

Risk Factors: We assess things like how much liquidity it has and the complexity of its smart contracts to map out any potential weak spots.

Only after a protocol clears these hurdles is it added to the whitelist. This ensures your funds are only ever interacting with platforms that meet the highest standards for security and reliability.

What Happens if the Whole Market Takes a Nosedive?

This is where an automated system really proves its worth. When there's a market-wide downturn and yields are tanking everywhere, the AI’s primary mission switches from chasing high returns to protecting your capital.

It will automatically pull your funds and reallocate them to the safest, most stable protocols on its whitelist—even if it means settling for lower yields for a bit. The real advantages here are speed and logic.

An automated system can shift your funds to a safer position in seconds, way faster than any human could realistically react. It makes the move without emotion, protecting your principal until the market finds its footing again.

This isn't just about playing offense. A well-built real-time APY optimization platform is designed to play smart defense when the game changes.

Do I Have to Lock Up My Funds? Are There Fees to Withdraw?

Nope. Modern DeFi is built on the idea that you should always be in control of your money. There are absolutely no lockup periods, so your funds are always liquid and accessible when you need them.

On top of that, platforms like Yield Seeker don't charge any withdrawal fees. You have total freedom to manage your assets on your own terms, without getting dinged by surprise penalties.

The only costs you'll ever see are the standard network transaction fees (you'll often hear them called "gas" fees). These are part of the underlying blockchain itself, not something the platform controls, and they're a normal part of using any decentralized network. It’s a completely transparent setup that keeps you firmly in the driver's seat.

Ready to let AI put your stablecoins to work? With Yield Seeker, you can start earning smarter, automated yield in minutes. Just deposit as little as $10 USDC and let your personalized AI Agent take it from there.