That triple-digit APY looks incredible on the surface, but what’s the real story? Risk-adjusted APY is how savvy investors measure returns, because it accounts for the hidden dangers lurking behind that flashy advertised number. It tells you what you actually earn for the level of risk you’re taking on.

Moving Beyond Misleading APY Figures

In DeFi, it's easy to get mesmerized by sky-high Annual Percentage Yield (APY) figures. A brand-new protocol might promise a staggering 300% APY, making a more established platform’s 12% APY look downright boring.

But experienced investors know the highest number is rarely the best deal.

Think of it like comparing two job offers. One is a massive salary at a volatile startup with an uncertain future. The other is a solid, respectable salary at a stable company with a long track record. The startup offers a bigger immediate reward, sure, but the risk of it failing—and you losing your job—is significantly higher. The stable company provides a more reliable path to building long-term wealth.

Why Your Real Return Is Often Different

This is the core idea behind risk-adjusted APY. It forces you to ask the most important question in finance: "Am I being properly compensated for the risks I'm taking?"

That flashy 300% APY might be propped up by unaudited smart contracts, paper-thin liquidity, or an unproven token. These factors dramatically increase your chances of losing everything, making that headline number a mirage.

A high nominal APY is a marketing tool. A high risk-adjusted APY is a sign of a genuinely good investment. It separates sustainable opportunities from speculative gambles.

The standard APY figure only tells you half the story—the potential reward. We cover the basic calculations in our guide on what is Annual Percentage Yield, but that number completely ignores the potential for loss.

A risk-adjusted APY, on the other hand, gives you the full picture. It levels the playing field, helping you compare different opportunities on an equal footing by factoring in all the threats that could wipe out your returns.

To put it simply, here’s how the two metrics stack up.

Nominal APY vs Risk-Adjusted APY at a Glance

Metric | Nominal APY | Risk-Adjusted APY |

|---|---|---|

Primary Focus | Maximum potential return | Sustainable return after risks |

What It Tells You | "How much could I earn?" | "How much am I likely to earn for the risk?" |

Risk Consideration | Ignores all underlying risks | Actively factors in risks like volatility, smart contracts, etc. |

Best For | Quick, surface-level comparison | In-depth, quality investment decisions |

This table makes it clear: while nominal APY grabs your attention, risk-adjusted APY guides your strategy.

The Shift to Smarter Yield Farming

Focusing on risk-adjusted returns is what separates short-term speculators from long-term builders in the DeFi space. Instead of chasing fleeting, high-risk yields that can evaporate overnight, you can identify strategies that deliver consistent, dependable growth.

The good news? You no longer have to perform this complex analysis manually. Modern AI-powered platforms like Yield Seeker are built to do this heavy lifting for you. They continuously analyze dozens of protocols, assessing underlying risks to surface opportunities with the best risk-adjusted APY, helping you earn smarter without the headache.

How We Actually Calculate Risk-Adjusted Returns

Figuring out a true risk-adjusted APY isn't about plugging numbers into one magic formula. It’s more like building a complete picture of what could really happen with your money by combining a few different models.

These methods take the fuzzy idea of "risk" and turn it into a hard number you can actually use—something you can subtract from that shiny headline APY to see what's left.

Let's walk through three of the most common approaches we use to get a much clearer view of an investment's real quality.

Expected Loss Adjustment

Think of this like paying for insurance on your DeFi position. You wouldn't drive your car without it, right? This method applies the same logic to your capital. It starts by estimating the chances of a disaster—like a smart contract getting hacked or a stablecoin losing its peg—and then calculates how much you’d lose if it happened.

This "insurance premium" gets subtracted from the advertised APY. So, a protocol shouting about its 20% APY might have a 5% chance of a complete meltdown. The expected loss adjustment would knock its actual return down to 15%. This simple math immediately makes it easier to compare against a safer protocol offering a steady 12%.

Volatility-Adjusted Returns

Let's be real: not all returns are the same. Earning a predictable 1% every month is a world away from gaining 10% one month only to lose 8% the next, even if the "average" looks similar on paper. Volatility adjustment is all about measuring the consistency of your earnings.

This approach penalizes strategies that have wild, unpredictable swings. A high-volatility investment is like climbing a rickety ladder—you might get to the top, but the whole journey is stressful and you could fall at any moment. A low-volatility one is a solid staircase, giving you a much more reliable path up.

This is a critical concept if you're looking for dependable passive income instead of a speculative thrill ride. If you want to dig into the basic math, check out our guide on how to calculate investment returns.

The whole point of a volatility adjustment is to reward consistency. It answers the question: "How smooth is the ride to my target return?" A smoother ride means less risk and a better quality investment.

This isn't some new DeFi invention; it has deep roots in traditional finance. During the 2008 financial crisis, one-year CD averages tanked to below 1% APY, but their rock-solid stability (thanks to FDIC insurance) made them a safe harbor for investors fleeing chaos. Just a few years later, in June 2013, the average one-year CD offered a tiny 0.24% APY, showing just how much risk perception shapes returns everywhere.

Sharpe and Sortino Ratios

If the methods we just covered are the ingredients, ratios like Sharpe and Sortino are the final "performance score." They wrap all that complex information into a single, easy-to-compare number.

Sharpe Ratio: This is the old-school classic. It measures your return for every unit of total risk you take on (that includes both the good and bad kinds of volatility). A higher Sharpe Ratio is always better.

Sortino Ratio: This one is a bit smarter and more refined for our purposes. It only measures your return against downside risk—the bad volatility that actually costs you money. This is way more useful in DeFi, because let's be honest, nobody complains about unexpected gains.

These ratios are powerful because they give us a standardized way to compare apples to apples. For a deeper look at the core concept, it's worth exploring what a risk-adjusted return is and why it's a far better metric for making smart decisions. They help you finally answer whether Strategy A's 15% APY with high risk is truly better than Strategy B's 10% APY with low risk.

The Hidden DeFi Risks That APYs Ignore

Headline APYs tell you what you could earn, but they hide what you could lose. That advertised yield is just one number, and honestly, it's often a misleading one. To really size up a DeFi opportunity, you have to look past the flashy percentage and dig into the invisible risks lurking just beneath the surface.

A high APY doesn't mean much if the protocol it's coming from is built on shaky ground. Think about it: a 20% APY from some new, unaudited project is a world away from a 10% APY offered by a platform that's been battle-tested for years. The real goal is to figure out a true risk-adjusted APY, and that starts with us identifying and pricing in these specific threats.

These aren't just hypotheticals, either. These risks have been responsible for billions of dollars in lost funds across DeFi. Getting a handle on them is the first step toward protecting your capital and making much smarter calls.

The Five Critical Threats in DeFi

Every single DeFi protocol comes with its own unique risk profile. While the list of things that can go wrong is long, five main categories are behind the vast majority of catastrophic losses. If you ignore even one of them, a promising yield can go straight to zero.

Let's break down the most critical threats you absolutely need to watch for:

Smart Contract Risk: This is the big one, the most infamous risk in all of DeFi. A single bug, an oversight, or an exploit in a protocol's code can open the door for an attacker to drain its entire treasury. The 2016 DAO hack, which was so bad it led to the fork of Ethereum itself, is the classic example of code being exploited with devastating results.

Oracle Risk: DeFi protocols don't operate in a vacuum; they rely on "oracles" to feed them real-world data, like the current price of ETH. If this data feed gets manipulated or is just plain wrong, it can trigger unfair liquidations and cause a domino effect of failures across the system. Back in 2020, the bZx protocol got hit twice in one week, losing over $900,000 because of oracle manipulation.

A protocol is only as secure as its weakest link. A single flaw in its code, data feeds, or governance can completely undermine even the most attractive APY.

Depegging, Governance, and Liquidity Dangers

Beyond the code and the data feeds, other structural risks can completely wipe out your returns. These are often a bit harder to spot but are just as dangerous, impacting everything from stablecoins to your simple ability to get your funds out.

Depeg Risk is the danger that a stablecoin—which is supposed to hold a 1:1 value with a currency like the US dollar—loses its peg and crashes. The dramatic collapse of Terra's UST stablecoin in 2022 vaporized over $40 billion in value, proving just how quickly a depeg can spiral out of control.

Next up is Protocol Governance Risk. This is where a flawed or even malicious community vote can seriously damage a project. A poorly thought-out proposal could mess with the tokenomics, introduce a security hole, or just change the rules in a way that hurts the people providing liquidity.

Finally, there’s Liquidity Risk, which can stop you from withdrawing your funds when you need to. Even if a protocol is totally secure, it might not have enough available assets if a ton of users all try to head for the exit at once. Our detailed guide on liquidity pool risks dives deep into how this can trap your capital indefinitely. These five risks are exactly why chasing the highest APY is almost always a losing game.

Calculating Risk-Adjusted APY in a Real-World Scenario

Okay, let's move away from theory and walk through a practical example. This is where the rubber meets the road and we can see how a risk-adjusted APY calculation totally changes the game for two different DeFi strategies. Abstract ideas like "smart contract risk" suddenly become very real when you start putting numbers to them.

Imagine you're looking at two stablecoin opportunities:

Strategy A: A brand new, unaudited protocol that’s dangling a very juicy 25% APY.

Strategy B: A well-established, battle-tested platform like Aave, offering a more conservative 12% APY.

On the surface, Strategy A looks like a no-brainer. But this is the point where a smart investor hits pause and starts asking the hard questions about what’s lurking under the hood.

The Risk Deduction Process

To get the full picture, we have to apply a "risk penalty" to each strategy. Think of it as pricing in the potential for things to go wrong. We can score key risk factors—like the chance of a smart contract exploit or wild APY swings—and subtract that penalty from the headline number.

Let's assign some hypothetical risk deductions based on what we know about each protocol:

Strategy A (High Risk): Since it's new and unaudited, we might slap it with a -10% deduction for smart contract risk. Its APY is also likely to be all over the place, so let's add another -7% for volatility.

Strategy B (Low Risk): Being a time-tested platform, its smart contract risk is far lower, maybe just -1%. The APY is also much more stable, so a smaller -1% deduction feels right.

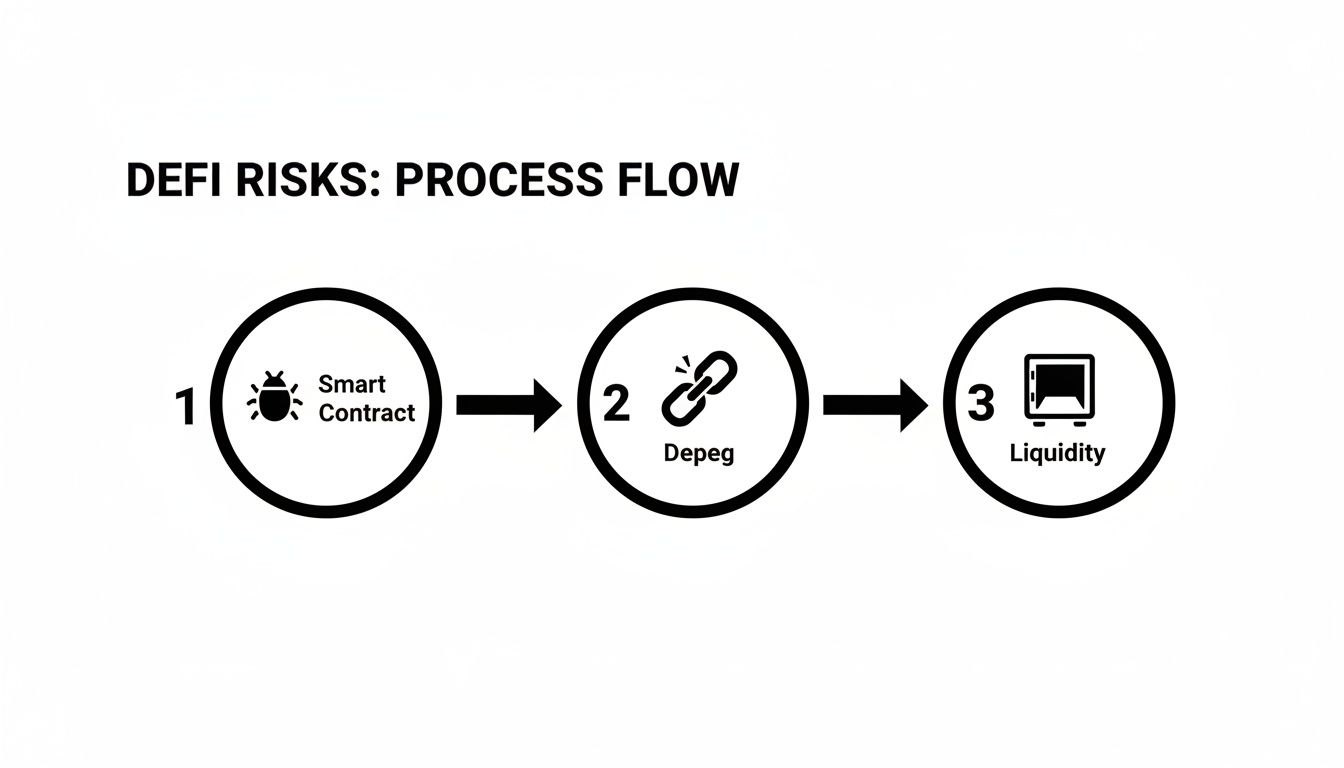

The diagram below breaks down the main risks we’re thinking about here—smart contract bugs, stablecoin depegs, and liquidity freezes—which all factor into these deductions.

This flow really highlights how a single weak point in any one of these areas can lead to a complete loss of funds. That's why this assessment is so critical.

Uncovering the True Winner

Now for the fun part. Let's apply these deductions and see what happens. This is the moment of truth where the "better" strategy gets a serious reality check.

The table below provides a step-by-step breakdown of how this plays out.

Worked Example Strategy A vs Strategy B

Metric | Strategy A (High APY, High Risk) | Strategy B (Lower APY, Low Risk) |

|---|---|---|

Advertised APY | 25% | 12% |

Smart Contract Risk Deduction | -10% | -1% |

APY Volatility Risk Deduction | -7% | -1% |

Total Risk Deduction | -17% | -2% |

Risk-Adjusted APY | 8% | 10% |

When you lay it all out, the picture flips completely.

The advertised APY is the starting point, not the finish line. The true return is what remains after you’ve accounted for what you stand to lose.

The "safer" strategy with the lower advertised yield actually offers a superior return once we factor in the risk. Strategy A's impressive 25% APY completely crumbles under pressure, while Strategy B's modest 12% proves to be far more resilient.

Suddenly, Strategy B is the clear winner with a 10% Risk-Adjusted APY, beating out Strategy A's 8%. This simple exercise proves the whole point of this guide: the number you see upfront is only half the story. Calculating a risk-adjusted APY reveals what you’re truly getting paid for the danger you’re taking on.

How AI Finds Superior Risk-Aware Yields

Let's be honest, manually calculating a true risk-adjusted APY is a nightmare. It’s a full-time job that requires you to be constantly plugged in, have a deep technical grasp of DeFi, and somehow process a firehose of real-time data from dozens of protocols at once.

This is exactly where an AI-powered platform like Yield Seeker comes in. It turns an impossible research project into a massive analytical advantage. It's not just chasing the highest advertised number; it’s your tireless, 24/7 analyst doing the heavy lifting no human ever could.

The AI Analyst at Work

An AI agent doesn’t just glance at a protocol’s homepage and call it a day. It dives deep, running thousands of continuous calculations to figure out the real quality of a yield opportunity. This isn't a one-and-done analysis; it's a constant, multi-layered process.

The system is always monitoring key risk indicators across the entire DeFi space, including:

Smart Contract Security: Digging into audit histories, code complexity, and on-chain activity to flag potential weak points.

Liquidity Depth: Making sure there are enough assets in a pool for you to get in and out smoothly, so you don't get stuck.

Historical Volatility: Looking at past performance to penalize erratic, unreliable yields and reward the ones that are stable and consistent.

Transaction Volume: High volume is a great sign of a healthy, trusted protocol with real users.

By weighing all these factors in real-time, the AI pinpoints opportunities that offer the best possible return for a given level of risk. This saves you countless hours of slogging through research and helps you sidestep some serious dangers.

The Yield Seeker dashboard gives you a clean, simple view of your earnings, showing how all that complex backend analysis gets boiled down for the user. This interface translates thousands of risk calculations into a clear, actionable summary of how your portfolio is doing.

Surpassing Traditional Yield Options

This level of analysis is why AI-driven DeFi can consistently find opportunities that blow traditional finance out of the water. Just look at the risk-adjusted APY across different asset classes.

As of January 6, 2026, the ICE BofA US High Yield Index was offering a 6.50% effective yield. Sounds decent, right? But that headline number hides an implied 3-5% annual default risk, which brings its real return much closer to the "risk-free" Treasury Bill rate of around 4-4.5%. You can dig into high-yield bond data on the FRED website to see for yourself.

By spreading capital across multiple vetted protocols and using oracle data to watch for threats, an AI system can capture superior risk-adjusted returns that are just not possible with fragmented, old-school financial products.

Just as AI is changing how we find great yields, it's also a powerhouse in security. For anyone curious about the bigger picture, understanding how experts are harnessing AI for enhanced cybersecurity risk management offers some great context, since it directly tackles one of DeFi's core risks.

Ultimately, this AI-driven approach gives you access to diversified, risk-aware strategies that are impossible for one person to manage. It’s simply a smarter way to earn.

Answering Your Questions on Risk-Adjusted APY

Even after getting the concepts down, a few practical questions always pop up when you start applying risk-adjusted APY to real DeFi strategies. Let's tackle some of the most common ones to make sure everything is crystal clear.

Is a Higher Risk-Adjusted APY Always Better?

Generally, yes. A higher risk-adjusted APY is a strong signal that you're getting more bang for your buck—more return for every unit of risk you're taking on. It means a strategy is just plain more efficient at generating yield compared to its potential stumbles.

But here’s the thing: personal risk tolerance is the final piece of the puzzle. An aggressive strategy might have a fantastic risk-adjusted APY but still come with a level of volatility that would make a conservative investor lose sleep. The real sweet spot is finding a strategy that has a strong risk-adjusted return and fits your own financial goals.

The best strategy for you isn't just the one with the highest number on paper. It's the one that lets you sleep at night, balancing mathematical efficiency with your own comfort level.

Can I Calculate Risk-Adjusted APY on My Own?

You can absolutely run a simplified calculation, a lot like the example we walked through earlier. It's actually a great way to compare a couple of strategies head-to-head and really get a feel for how the core principles work.

However, a truly accurate calculation in the wild, fast-moving world of DeFi is a whole different beast. It demands a constant stream of real-time data on everything from smart contract dependencies and liquidity levels to market sentiment and governance votes. Modeling potential losses correctly is a full-time job for experts. This is exactly why automated platforms are so powerful—they have sophisticated models doing all that heavy lifting for you, around the clock.

How Do Automated Platforms Manage Risk?

Automated platforms don't just find one "safe" protocol and call it a day. They use a multi-layered approach to protect your capital while chasing competitive yields. Think of it as building a resilient system, not just picking a single winner.

This system usually boils down to three core pillars:

Protocol Vetting: They only interact with a pre-vetted list of reputable DeFi protocols that have passed strict security and performance checks. No random, untested stuff.

Smart Diversification: Your capital is intelligently spread across multiple strategies and platforms. This way, a single point of failure can't cause catastrophic losses.

Proactive Monitoring: They're constantly scanning on-chain data for red flags, which lets them reallocate funds before a potential problem blows up.

It's this combination of careful selection, diversification, and non-stop monitoring that lets them deliver competitive, risk-aware returns.

What's the Difference Between TVL and Risk-Adjusted APY?

Total Value Locked (TVL) just tells you how much money is currently sitting in a protocol. People often use it as a rough proxy for trust—a high TVL might suggest a lot of people think the platform is legit.

But that's where its usefulness ends. TVL tells you absolutely nothing about the return you can actually earn or the specific risks you're taking on. Risk-adjusted APY, on the other hand, is a true performance metric. It measures the efficiency of your earnings against the risk you're exposed to.

A protocol can easily have a sky-high TVL but offer a pretty terrible risk-adjusted return. While a savvy investor might glance at both, they'll always prioritize risk-adjusted APY when it's time to make a decision.

Ready to stop chasing misleading yields and start earning smarter? Yield Seeker's AI-powered platform does the heavy lifting, continuously analyzing the DeFi landscape to find superior risk-adjusted returns for your stablecoins. Put your capital to work with confidence. Start earning with Yield Seeker today.